Get Irs 1040 - Schedule E 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

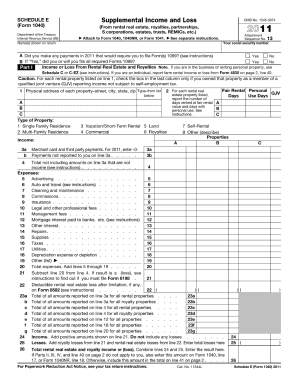

The IRS 1040 - Schedule E is a crucial form for reporting income or losses from rental real estate, partnership, S corporations, estates, trusts, and other sources. This guide will provide clear, step-by-step instructions to help users navigate the process of filling out the form online.

Follow the steps to complete the IRS 1040 - Schedule E effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin with Part I, which focuses on income or loss from rental real estate. Enter the address of each property in column (a), followed by the income received in column (b) and any deductible expenses in the subsequent columns.

- Complete Part II if you have income or loss from partnerships or S corporations. Enter the name of the entity in column (a), the amount of income or loss in column (b), and any related deductions.

- If applicable, continue to Part III for income or loss from estates and trusts. Document the name of the estate or trust and the amounts allocated.

- For Part IV, complete information regarding any supplemental income or loss from other sources, and ensure you've summarized all applicable income and losses.

- Once all sections are filled out, review the entries for accuracy and completeness. Ensure all figures properly reflect your financial situation.

- Finally, save your changes, download the filled form, or print it for your records. Sharing options may also be available if you need to send it to a tax professional.

Complete your IRS 1040 - Schedule E online today to ensure accurate reporting and compliance.

Get form

Related links form

Completing Schedule E is crucial, as it directly impacts your overall tax liability by reporting income and losses from rental properties and other sources. Properly filling out this form can lead to potential deductions, ultimately reducing the amount of tax you owe. Consequently, understanding the implications of IRS 1040 - Schedule E can empower you to make informed financial decisions and optimize your tax returns.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.