Loading

Get Irs 1040 - Schedule C-ez 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C-EZ online

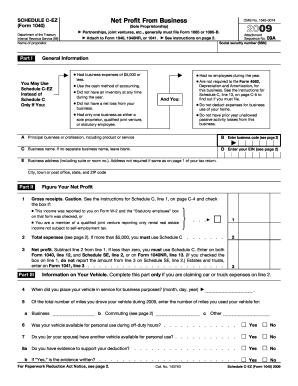

Filling out the IRS 1040 - Schedule C-EZ is essential for reporting income from a sole proprietorship. This guide will provide step-by-step instructions to help users complete the form with confidence and accuracy.

Follow the steps to effectively complete the IRS 1040 - Schedule C-EZ online.

- Click the ‘Get Form’ button to access the IRS 1040 - Schedule C-EZ form and open it in your editing tool.

- Provide your name as the proprietor in the designated field. Ensure it matches the personal information on your primary tax return.

- Enter your social security number (SSN). This is crucial for identifying your tax records.

- In Part I, describe your principal business or profession, indicating the primary activity or service you provide.

- Fill in the business code associated with your activity. You can find this code in the IRS instructions for Schedule C.

- If applicable, provide your business name. If you do not have a separate business name, leave this field blank.

- Enter your employer identification number (EIN) if you have one. This is not required if you do not own an EIN.

- Provide the business address, including street number, suite or room number if necessary, and city, state, and ZIP code.

- In Part II, report your gross receipts in the first line. Include all taxable income received for the year.

- List your total business expenses in line two. Remember, if expenses exceed $5,000, you will need to use Schedule C instead.

- Calculate your net profit by subtracting your total expenses from your gross receipts. If the result is less than zero, you must use Schedule C.

- If you are claiming vehicle expenses, complete Part III regarding your vehicle usage. Include all relevant mileage and usage information.

- Review all entries for accuracy. Make any necessary corrections before finalizing the form.

- Once satisfied with the form, you can choose to save your changes, download, print, or share the completed Schedule C-EZ as needed.

Complete your IRS forms online today for a smooth and efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Since the EZ tax form is now obsolete, focus on filling out the standard Form 1040 and, if applicable, the IRS 1040 - Schedule C-EZ. Both forms have clear instructions to guide you through the process. You can also consider using online platforms like USLegalForms, which provide resources and templates that can simplify your tax preparation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.