Loading

Get Irs 1040 - Schedule C-ez 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C-EZ online

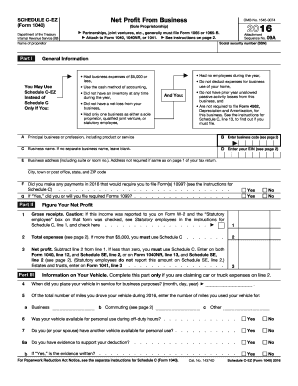

This guide provides a comprehensive, step-by-step approach to filling out the IRS 1040 - Schedule C-EZ online. Designed for individuals with varying levels of experience, this resource supports users in accurately reporting their business income.

Follow the steps to complete your Schedule C-EZ with ease.

- Click the ‘Get Form’ button to obtain the IRS 1040 - Schedule C-EZ form and open it in the provided editor.

- Enter your social security number (SSN) and general information about your business, including the name of the proprietor, business name, and address. If your business address is the same as your tax return, you may leave the address blank.

- Provide the business code that corresponds to your principal business activity as instructed on the form.

- Indicate whether you made any payments that necessitate filing Form 1099. If yes, state if you will file the required forms.

- Calculate your gross receipts by entering the total income received from your business in line 1.

- Next, enter your total deductible business expenses in line 2. Ensure that your total expenses do not exceed $5,000 to qualify for Schedule C-EZ.

- Subtract line 2 from line 1 to find your net profit and enter this figure in line 3. If the result indicates a loss, you will need to use Schedule C instead.

- If you claim car or truck expenses, complete Part III by detailing vehicle usage, including business miles and personal use.

- Review all entries for accuracy and completeness before saving your changes.

- Finally, download, print, or share the completed form as needed.

Start filling out your IRS 1040 - Schedule C-EZ online today for accurate business income reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 1040 EZ does not exist anymore as it was discontinued by the IRS. The tax landscape has changed, resulting in the adoption of the traditional 1040 form and other related schedules to capture more detail about taxpayer circumstances. These changes promote accuracy and transparency in reporting. If you need help with the new forms, turn to resources like uslegalforms for reliable information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.