Loading

Get Irs 1040 - Schedule C 2007

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C online

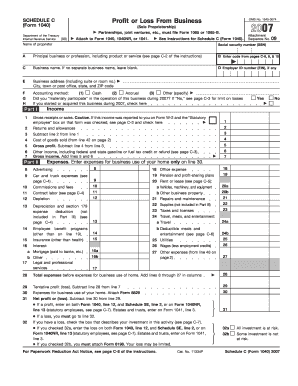

The IRS 1040 - Schedule C is a crucial document for individuals operating a sole proprietorship. This guide will help you understand and complete each section of the form online with clarity and confidence.

Follow the steps to successfully complete your Schedule C.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the name of the proprietor and enter your social security number in the designated fields.

- Provide the principal business or profession, including a brief description of the product or service offered, in the specified section.

- Enter the business name if applicable, or leave it blank if there is none.

- If you have an employer ID number, include it in the corresponding field; otherwise, leave it blank.

- Fill in the business address, including suite or room number, city, state, and ZIP code.

- Select your accounting method by checking the appropriate box for cash, accrual, or other.

- Indicate whether you materially participated in the operation of the business during the tax year.

- Complete Part I by entering your gross receipts or sales and any returns and allowances.

- Calculate your cost of goods sold and necessary expenses, filling out all relevant fields.

- Total your expenses before entering the specific expenses related to business use of your home.

- Determine your tentative profit or loss by subtracting total expenses from gross income.

- If applicable, enter expenses for business use of your home and calculate your net profit or loss.

- As a final step, review all entries for accuracy before saving, downloading, or printing the completed form.

Start filling out your IRS 1040 - Schedule C online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To avoid an IRS audit on your Schedule C, ensure that all your financial records are accurate and complete. Report all income, avoid excessive or unusual deductions, and maintain clear documentation to support your claims. Utilizing platforms like US Legal Forms can help streamline your tax preparation process and keep you compliant. By being organized and meticulous, you can significantly reduce your audit risks.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.