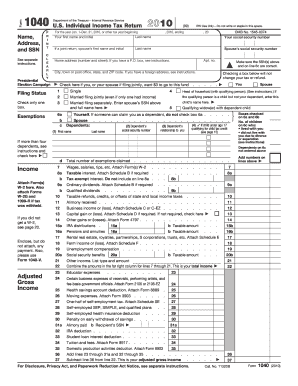

Get Irs 1040 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 online

How to fill out and sign IRS 1040 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or you simply overlooked it, it could likely cause issues for you. The IRS 1040 is not the easiest form, but you shouldn't be concerned in any case.

By utilizing our expert platform, you will learn how to complete IRS 1040 even during times of significant time shortages. You only need to follow these straightforward directions:

With our robust digital solution and its advantageous tools, completing IRS 1040 becomes more efficient. Don't hesitate to make use of it and spend more time on enjoyable activities rather than preparing paperwork.

- Access the document in our state-of-the-art PDF editor.

- Input the necessary details in IRS 1040, utilizing fillable fields.

- Add images, checks, crosses, and text boxes, if required.

- Repeating information will be automatically populated after the initial entry.

- If you encounter difficulties, activate the Wizard Tool. You will receive helpful suggestions for easier submission.

- Remember to add the application date.

- Create your unique signature once and place it in all the required fields.

- Review the information you have entered. Rectify errors if needed.

- Press Done to complete modifications and choose the method of submission. You will have the option to use digital fax, USPS, or email.

- You can also download the document to print it later or upload it to cloud storage.

How to modify Get IRS 1040 2010: personalize forms online

Utilize the capabilities of the versatile online editor while completing your Get IRS 1040 2010. Leverage the variety of tools to swiftly fill in the blanks and supply the necessary information in no time.

Preparing documents can be labor-intensive and expensive unless you have pre-prepared fillable forms to complete electronically. The optimal approach to handle the Get IRS 1040 2010 is to take advantage of our expert and feature-rich online editing solutions. We offer you all the essential tools for rapid document completion and enable you to make any modifications to your forms, customizing them to meet any requirements. Additionally, you can comment on the changes and leave notes for other participants.

Here’s what you can achieve with your Get IRS 1040 2010 in our editor:

Utilizing Get IRS 1040 2010 in our robust online editor is the fastest and most efficient method to handle, submit, and share your paperwork in the manner you need it from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-connected device. All forms you create or complete are securely preserved in the cloud, ensuring that you can always retrieve them when needed and rest assured about their safety. Stop squandering time on manual document completion and eliminate paperwork; transition everything online with minimal effort.

- Complete the blanks using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize crucial details with a selected color or underline them.

- Obscure sensitive data with the Blackout tool or simply obliterate them.

- Insert images to illustrate your Get IRS 1040 2010.

- Substitute the original text with the content that meets your requirements.

- Add remarks or sticky notes to notify others about the revisions.

- Include additional fillable sections and assign them to specific recipients.

- Secure the template with watermarks, incorporate dates, and bates numbers.

- Distribute the document in multiple ways and save it on your device or cloud in various formats after finalizing the adjustments.

Get form

No, Form 1040 is not the same as a W-2 form. The IRS 1040 is the tax return form you file to report your annual income, while the W-2 form is a statement from your employer detailing your earnings and taxes withheld during the year. Understanding the difference is crucial for filing your taxes correctly. Platforms like US Legal Forms can aid in clarifying any confusion around these forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.