Loading

Get Mn Dor M4np 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M4NP online

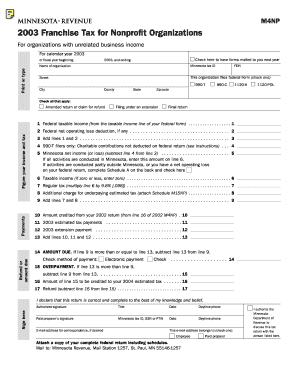

The MN DoR M4NP form is essential for nonprofit organizations reporting unrelated business income for the calendar year. This guide provides a clear, step-by-step overview of how to complete this form online, ensuring accuracy and compliance.

Follow the steps to accurately fill out the MN DoR M4NP form.

- Press the ‘Get Form’ button to retrieve the MN DoR M4NP form and open it for online completion.

- Input the name of your organization, along with the Minnesota tax ID and FEIN, ensuring all details are accurate.

- Provide the organization's address, including the street, city, county, state, and zip code.

- Indicate which federal form the organization files by checking the relevant box (990-T, 990-C, 1120-H, or 1120-POL).

- Check any applicable options regarding the return: amended return, filing under an extension, or final return.

- Enter the federal taxable income from the appropriate line of the federal form in Line 1.

- Report any federal net operating loss deduction, if applicable, in Line 2.

- Add Lines 1 and 2 together and record the result in Line 3.

- For 990-T filers, input any charitable contributions not deducted on the federal return in Line 4.

- Subtract Line 4 from Line 3 to calculate your Minnesota net income or loss in Line 5.

- If all activities are conducted in Minnesota, transfer this amount directly to Line 6. If activities extend outside Minnesota, complete Schedule A.

- Calculate the taxable income for Line 6. If the result is zero or less, enter zero.

- Multiply the income from Line 6 by the tax rate of 9.8% and record this amount in Line 7.

- If applicable, include any additional charge for underpaying estimated tax in Line 8.

- Add Lines 7 and 8 together for the total amount due in Line 9.

- List any credits from your previous year return in Line 10. Include any estimated tax payments for 2003 in Line 11 and any extension payment in Line 12.

- Total Lines 10, 11, and 12 in Line 13.

- If Line 9 is greater than or equal to Line 13, calculate the amount due by subtracting Line 13 from Line 9 for Line 14. Choose your payment method.

- If you have an overpayment, determine this by subtracting Line 9 from Line 13 for Line 15.

- Decide how much of the refund you would like credited to your estimated tax for 2004 in Line 16.

- Calculate your refund by subtracting Line 16 from Line 15 for Line 17.

- Sign and date the form. Provide your daytime phone number and any paid preparer's information if applicable. Ensure you attach a copy of the complete federal return.

- After completing the form, save your changes, download a copy for your records, print, or share as needed.

Complete the MN DoR M4NP form online today to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Establishing residency in Minnesota involves several steps, such as securing a permanent address, obtaining a Minnesota driver's license, and registering for local services. Additionally, maintaining consistent proof of your ties to the state through tax filings or community involvement can bolster your residency claim. It's important to stay informed of the MN DoR M4NP guidelines throughout this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.