Get De Dor 200-01-x-i 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign DE DoR 200-01-X-I online

How to fill out and sign DE DoR 200-01-X-I online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period started suddenly or perhaps you simply overlooked it, it might lead to complications for you.

DE DoR 200-01-X-I isn't the most straightforward form, but you don't need to be concerned in any situation.

With this efficient digital tool and its professional features, completing DE DoR 200-01-X-I becomes simpler. Don't hesitate to utilize it and gain more time for hobbies and interests instead of focusing on preparing documents.

- Open the file using our expert PDF editor.

- Complete the information needed in DE DoR 200-01-X-I, using the fillable sections.

- Add images, crosses, check boxes, and text boxes if necessary.

- Duplicating fields will be inserted automatically after the first entry.

- If you encounter any difficulties, activate the Wizard Tool for helpful hints on making it easier.

- Always remember to append the application date.

- Create your personal e-signature once and place it in all required areas.

- Review the information you’ve entered. Make corrections if necessary.

- Click on Done to finalize changes and choose how you want to submit it. You may opt for online fax, USPS, or email.

- You can also save the document for later printing or upload it to a cloud service like Google Drive, OneDrive, etc.

How to modify Get DE DoR 200-01-X-I 2015: personalize forms digitally

Experience the functionality of the multifunctional online editor while finalizing your Get DE DoR 200-01-X-I 2015. Utilize the array of tools to swiftly fill in the gaps and provide the necessary information right away.

Creating paperwork is labor-intensive and costly unless you have pre-prepared fillable forms and complete them electronically. The easiest method to handle the Get DE DoR 200-01-X-I 2015 is to employ our professional and versatile online editing tools. We furnish you with all the vital resources for quick document completion and allow you to make any modifications to your templates, tailoring them to any specifications. Moreover, you can annotate the alterations and leave notes for other stakeholders.

Here’s what you can accomplish with your Get DE DoR 200-01-X-I 2015 in our editor:

Using Get DE DoR 200-01-X-I 2015 in our robust online editor is the swiftest and most effective means to manage, file, and distribute your documents the way you require from anywhere. The tool works from the cloud so that you can access it from any location on any internet-enabled device. All documents you create or prepare are securely stored in the cloud, allowing you to access them whenever necessary and be assured of not losing them. Cease wasting time on manual paperwork and eliminate paper; manage everything online with minimal effort.

- Complete the blank sections using Text, Cross, Check, Initials, Date, and Signature tools.

- Emphasize important details with a preferred color or underline them.

- Mask sensitive information with the Blackout feature or simply eliminate them.

- Include images to illustrate your Get DE DoR 200-01-X-I 2015.

- Substitute the original wording with the one that fits your needs.

- Add comments or sticky notes to notify others about the modifications.

- Insert additional fillable fields and assign them to designated recipients.

- Secure the document with watermarks, incorporate dates, and bates numbers.

- Distribute the document in various methods and save it on your device or the cloud in multiple formats once you finish editing.

Get form

Related links form

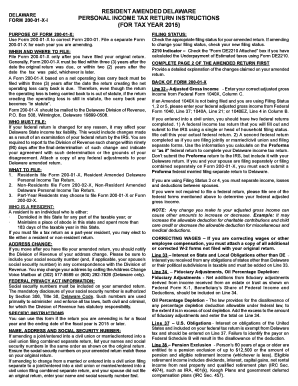

Individuals who earn income from Delaware sources or those who are Delaware residents are typically required to file a tax return. Additionally, any non-resident who earns income in Delaware must also file. To understand specific requirements based on your situation, refer to DE DoR 200-01-X-I, or consult a tax professional for tailored advice.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.