Get Md Bcps Employee Combined Withholding Allowance Certificate 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD BCPS Employee Combined Withholding Allowance Certificate online

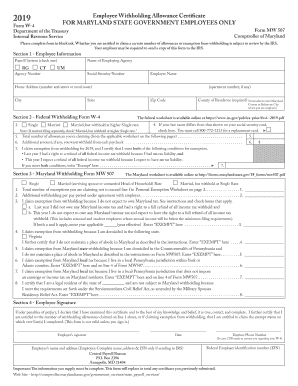

Completing the MD BCPS Employee Combined Withholding Allowance Certificate is essential for correctly managing your tax withholding as a Maryland state government employee. This guide provides a clear, step-by-step process to assist you in filling out the form online efficiently.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the MD BCPS Employee Combined Withholding Allowance Certificate and open it in your document editor.

- In Section 1, enter your employee information, including your payroll system by checking the appropriate box, agency number, employee name, social security number, home address, city, state, and zip code. Be sure all information is accurate.

- Proceed to Section 2 to fill out the federal withholding information. Here, refer to the federal worksheet for total number of allowances you plan to claim and indicate if your last name differs from that on your social security card.

- In Section 2, continue to complete the fields regarding the total number of allowances, and any additional amount you wish to be withheld from your paychecks.

- If claiming exemption from federal withholding, check the appropriate box under Section 2 and provide the required certification.

- Move on to Section 3 to fill out the Maryland withholding information. Again, reference the Maryland worksheet for the total number of exemptions you are claiming and any additional withholding agreements with your employer.

- Indicate your exemption status for Maryland withholding by checking the appropriate boxes and providing any required explanations. Ensure you follow the instructions clearly.

- Finally, in Section 4, review your entries for accuracy, then sign and date the certificate. This step is crucial as the form is invalid without your signature.

- Once you have completed the form, you can save the changes, download it, print it, or share the completed document as needed.

Complete your MD BCPS Employee Combined Withholding Allowance Certificate online today to ensure proper withholding.

Get form

Filling out the W4 form in Maryland involves declaring your filing status, adjusting the number of allowances, and considering any additional amount you want to withhold. It's crucial to ensure that the details align with the information on your MD BCPS Employee Combined Withholding Allowance Certificate to avoid withholding errors. This form helps you manage your tax liability effectively and ensures accuracy in your employer's withholding practices.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.