Loading

Get Dc D-40p 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC D-40P online

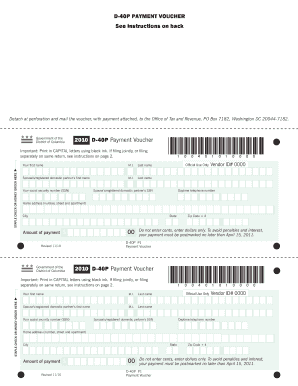

The DC D-40P Payment Voucher is an essential form for residents who need to make payments related to their income tax returns. This guide provides comprehensive instructions on how to accurately complete the form online, ensuring a smooth filing process.

Follow the steps to fill out the DC D-40P Payment Voucher

- Click ‘Get Form’ button to obtain the D-40P form and open it for editing.

- Begin by entering your first name, middle initial, and last name in the appropriate fields. Ensure that you use capital letters and black ink if filling out a hard copy.

- Provide your social security number (SSN) in the specified section.

- Fill in your home address, including the street number, street name, and apartment number, if applicable.

- If filing jointly, repeat the process by entering the first name, middle initial, last name, and SSN of your spouse or registered domestic partner.

- Indicate your daytime telephone number and complete your city, state, and zip code fields.

- Enter the amount of payment. Note that you should only include whole dollars; do not include cents.

- Staple your check or money order to the D-40P form, ensuring it is visible and attached securely.

- Mail the completed D-40P along with your payment to the Office of Tax and Revenue at the specified address, ensuring it is postmarked by the payment deadline.

- After completing the form, save any changes made, and consider downloading or printing a copy for your records before submission.

Complete your DC D-40P Payment Voucher online today to ensure timely tax payments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Any unincorporated business operating in Washington, DC, must file the DC unincorporated business franchise tax return. This includes sole proprietorships and partnerships conducting business in the area. By properly filing this return alongside your DC D-40P, you ensure compliance and help avoid any potential penalties or interest on unpaid taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.