Loading

Get Pr Form 483.20 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Form 483.20 online

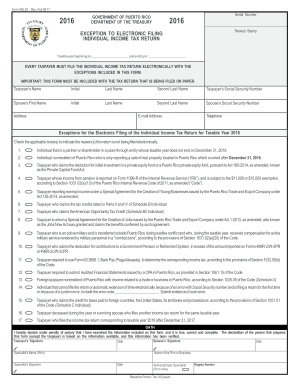

Filling out the PR Form 483.20 is essential for individuals who must file their income tax return on paper. This guide will provide a clear and professional walkthrough of each section of the form to ensure accurate completion.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Begin by entering the taxable year information in the designated fields, indicating the start and end dates accurately.

- Provide your personal information, including your full name, Social Security number, and contact details such as address, email address, and phone number.

- If applicable, include your spouse's details: first name, initial, last name, second last name, and Social Security number.

- Review the reasons for not filing electronically. Check the relevant boxes that apply to your situation. Ensure you provide accurate details for any exceptions claimed.

- Complete the oath section by signing and dating where indicated. Ensure all signatures required are clear and legible.

Start filling the PR Form 483.20 online today to ensure a smooth tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Formatting a PR address correctly is crucial for clarity and delivery. Start with the recipient's name, followed by the street address, city, and postal code. Finally, include the country line, which is particularly important when dealing with international documents or requirements like the PR Form 483.20 to ensure proper handling of your correspondence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.