Loading

Get Pa Schedule Pa-41x 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Schedule PA-41X online

Filling out the PA Schedule PA-41X is a crucial step for amending your Pennsylvania fiduciary income tax return. This guide provides detailed, step-by-step instructions to help you navigate each section of the form efficiently, ensuring compliance and accuracy.

Follow the steps to fill out the PA Schedule PA-41X online.

- Click ‘Get Form’ button to access the PA Schedule PA-41X and open it in the designated editor.

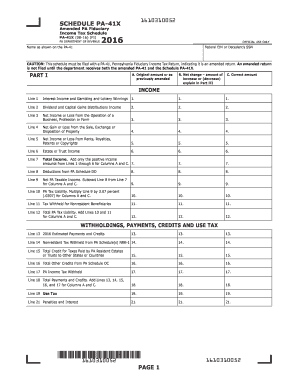

- Begin by entering the Federal Employer Identification Number (EIN) or the decedent’s Social Security Number (SSN) in the appropriate field at the top of the form.

- Provide the name exactly as it appears on the PA-41 in the specified section.

- In Part I, complete section A by indicating the original amount or previously amended amount.

- For section B, input the net change, specifying whether it is an increase or a decrease. Further explanation of this change should be made in Part III.

- Complete section C by entering the correct amount that reflects the needed adjustment.

- Proceed to fill in the various income lines (1 through 6), detailing any interest, dividends, business losses, gains from property, rental income, and estate or trust income.

- Calculate total income by adding all positive income amounts from Lines 1 through 6, recording this in Line 7.

- List any deductions from the PA Schedule DD in Line 8 and calculate the net PA taxable income by subtracting Line 8 from Line 7 in Line 9.

- Determine the PA tax liability by multiplying the net taxable income on Line 9 by 3.07 percent (.0307) for Lines 10.

- Fill in Line 11 to specify the tax withheld for nonresident beneficiaries.

- Combine Lines 10 and 11 to determine the total PA tax liability for Line 12.

- In the section for withholdings, payments, credits and use tax, fill in Lines 13 to 17 with relevant data on estimated payments, nonresident tax withheld, and other credits.

- Calculate the total payments and credits in Line 18 by adding together Lines 13, 14, 15, 16, and 17.

- Complete Line 19 with any applicable use tax.

- Document any penalties and interest in Line 21 as necessary.

- Move to Part II and detail the calculation of refund or payment due by following the prompts A through I. Make sure to keep accurate track of the amounts listed.

- In Part III, provide a full description or explanation of all changes made compared to the original or most recent return, including documentation as instructed.

- Once all fields are completed, save changes, download, print, or share the completed form as required.

Start filling out your PA Schedule PA-41X online to ensure accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Pennsylvania, certain beneficiaries may be exempt from inheritance tax, like surviving spouses and charitable organizations. Additionally, direct descendants, such as children and grandchildren, may enjoy lower rates. Understanding these exemptions can help you navigate the complexities of estate taxes while utilizing resources like the PA Schedule PA-41X effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.