Loading

Get Ri Ri-str-eft 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI-STR-EFT online

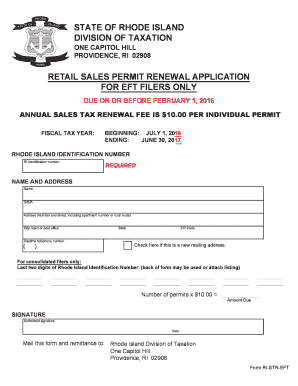

This guide provides clear and comprehensive instructions for completing the RI RI-STR-EFT form online. Designed for users with varying levels of experience, this step-by-step approach will help ensure accurate submission for your retail sales permit renewal.

Follow the steps to fill out the RI RI-STR-EFT form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in your Rhode Island identification number in the designated field. Ensure that this number is accurate as it is required for processing your application.

- Provide your name and address. Include details such as your doing business as (D/B/A) name, complete street address, city or town, state, and ZIP code.

- Enter your daytime telephone number in the appropriate field to ensure you can be contacted if there are any questions about your application.

- If your mailing address has changed, check the box indicating this new address. This will ensure that all correspondence is sent to the correct location.

- For those filing as consolidated filers, enter the last two digits of your Rhode Island identification number and confirm the number of permits you are renewing. Calculate the total amount due by multiplying the number of permits by $10.00.

- Sign and date the form to certify that the information provided is true and complete. Your authorized signature is necessary for processing your application.

- Once you have completed the form, review all entries for accuracy. Save your changes and download a copy if needed. You can also print the form or share it as required.

Complete your RI RI-STR-EFT form online today for a seamless renewal process.

The sales tax in Rhode Island, as managed by the Division of Taxation, is currently 7%. This tax applies to various goods and services, impacting both buyers and sellers. For businesses, keeping track of these rates is essential to remain compliant with RI RI-STR-EFT obligations and to avoid unnecessary complications in your operations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.