Get Va Form Va-8453p 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form VA-8453P online

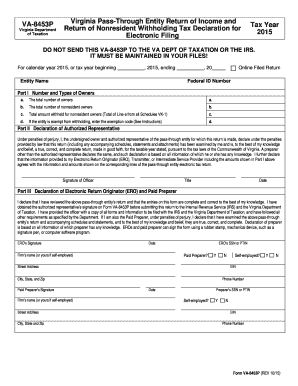

This guide will assist you in completing the VA Form VA-8453P, which is essential for documenting pass-through entity income and nonresident withholding tax declarations. By following the steps outlined below, users can ensure that the form is filled out accurately and efficiently.

Follow the steps to fill out the VA Form VA-8453P online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax year for which you are filing at the top of the form, ensuring that the year matches with your records.

- In the Entity Name field, provide the legal name of the pass-through entity. This is crucial for proper identification.

- Input the Federal ID Number assigned to the entity. This number is necessary for tax-related processes.

- Proceed to Part I. Here, indicate the total number of owners by filling in the corresponding field. This data helps categorize ownership.

- Next, note the total number of nonresident owners in the specified box. This will guide the withholding tax calculations.

- Enter the total amount withheld for nonresident owners, which should reflect the total from all Schedules VK-1 related to your entity.

- If applicable, indicate any exemption from withholding by entering the exemption code in the designated section.

- Move on to Part II, where the authorized representative must declare the accuracy of the return by signing and dating the form.

- In Part III, the Electronic Return Originator (ERO) or Paid Preparer must review the entries and provide their signature, date, and other required information.

- Once all entries are complete and verified, you can save your changes, download the completed form, and print or share it as needed.

Start filling out your VA Form VA-8453P online today and ensure your tax filing is accurate.

Get form

When sending VA tax forms, you need to mail them to the address specified by the Virginia Department of Taxation for different types of forms. It's crucial to ensure you have the correct address to avoid delays in processing. If you're using VA Form VA-8453P or any other specific forms, be sure to check the accompanying instructions for the correct mailing address. USLegalForms can help you find the right address and ensure your forms are submitted correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.