Loading

Get Ga Liquor By The Drink Excise Tax Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Liquor By The Drink Excise Tax Reporting Form online

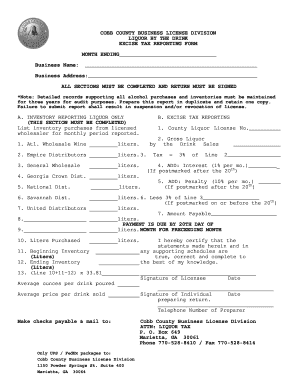

Filling out the GA Liquor By The Drink Excise Tax Reporting Form is essential for businesses in the liquor industry to report their sales and inventory accurately. This guide provides a clear, step-by-step approach to ensure you complete the form correctly and efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Fill in your business name and address in the designated fields. Ensure that every section is fully completed as it is mandatory.

- In the inventory reporting section (A), list all liquor inventory purchases from licensed wholesalers for the reporting month.

- Proceed to the excise tax reporting section (B). Input your County Liquor License Number and report your gross liquor sales from various wholesalers in the provided fields.

- Calculate the total amount payable by filling in the necessary information, including deductions and applicable taxes, ensuring accuracy in your calculations.

- Sign and date the form where indicated, verifying that all information provided is truthful and complete.

- Review the completed form for any errors before finalizing, as submission of an inaccurate report could lead to repercussions.

- Once completed, save your changes, and download or print the form for your records and submission.

Complete your documents online to ensure compliance and accuracy.

The excise tax on alcohol in Georgia varies widely depending on the type and size of the beverage. Generally, the rates are set per gallon for liquor, beer, and wine. It is essential to use the GA Liquor By The Drink Excise Tax Reporting Form to accurately report these taxes. This form simplifies the process and helps ensure your business meets all tax obligations without hassle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.