Loading

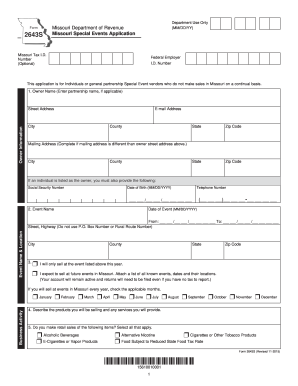

Get Mo Form 2643s 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form 2643S online

Filling out the MO Form 2643S online can streamline the application process for special event vendors in Missouri. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the MO Form 2643S online.

- Press the ‘Get Form’ button to access the MO Form 2643S in your online editor.

- Enter the owner information. If the owner is an individual, provide their name, mailing address, email address, city, county, state, zip code, social security number, and date of birth. If applicable, enter the partnership name.

- Fill out the event details, including the event name, date, and location. Specify the duration of the event from start to finish by entering the dates in the provided format.

- Indicate whether you will only sell at the listed event this year or if you expect to sell at future events. If the latter, attach a list of all known events including their dates and locations.

- List any months in which you plan to sell at events in Missouri and describe the products and services you will offer.

- If applicable, list the partners responsible for tax matters. Be sure to include each partner's name, social security number, home address, date of birth, title, and start date.

- Provide your signature, along with the date and printed name. Note that digital signatures are not allowed.

- After you have completed the form, ensure all information is accurate, then save your changes, download, or print the form to submit it as per your requirements.

Start completing your MO Form 2643S online today for a seamless application process.

Yes, remote sellers must register with the Missouri Secretary of State to comply with state sales tax requirements. This registration helps ensure that all sales made to Missouri residents are appropriately reported and taxed. Understanding the registration process, including any required documents like the MO Form 2643S, is essential for successful compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.