Get Ma Dor Schedule 3k-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR Schedule 3K-1 online

Completing the MA DoR Schedule 3K-1 online is a straightforward process that helps you report your partnership income and ensure compliance with Massachusetts tax regulations. This guide provides step-by-step instructions for accurately filling out each section of the form.

Follow the steps to successfully complete your MA DoR Schedule 3K-1 online.

- Click 'Get Form' button to obtain the form and open it for editing.

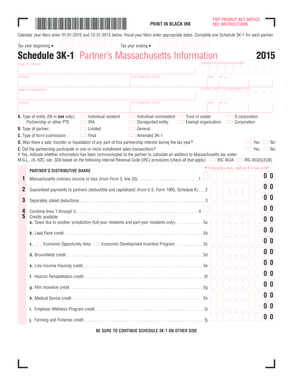

- Enter the tax year beginning and ending dates. For calendar year filers, use 01-01-2015 and 12-31-2015. Make sure to fill this accurately to reflect your filing period.

- Complete the partner's Massachusetts information, including taxpayer identification number, name, address, city/town, state, and ZIP code. This section is crucial for correctly identifying the partner.

- Fill in the federal identification number (FID) for the partnership and provide the partnership's name and address details.

- Select the type of entity from the provided options, ensuring you only fill in one. Options include 'Partnership or other PTE', 'Individual resident', 'Trust or estate', and others.

- Indicate the type of partner, choosing from 'Limited' or 'General'. This helps classify the partner's role within the entity.

- Specify the type of form submission: 'Final' or 'Amended 3K-1', as appropriate for your filing.

- Answer the questions related to any sale, transfer, or liquidation of partnership interests during the tax year by selecting 'Yes' or 'No'.

- If applicable, indicate whether the partnership participated in installment sales transactions and check the relevant boxes for IRC provisions.

- Proceed to enter the partner's distributive share of Massachusetts ordinary income or loss from the relevant form line, ensuring you reference accurate amounts.

- Continue filling out any additional income or deduction lines as necessary, following the format provided on the form.

- Once all information is entered, review the form for accuracy and completeness. Make any necessary adjustments.

- After confirming that all details are correct, save your changes. You can then download, print, or share the completed form as needed.

Complete your MA DoR Schedule 3K-1 online today for a smooth filing experience.

Get form

Calculating gross earnings requires you to add all income received, including salaries, tips, bonuses, and any additional income sources. For those using the MA DoR Schedule 3K-1, ensure you also incorporate your share of earnings from partnerships. This comprehensive figure represents your earnings before taxes and deductions, giving you a clear financial picture. Utilizing tax preparation tools can simplify this calculation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.