Get Mi Gr-1040nr 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI GR-1040NR online

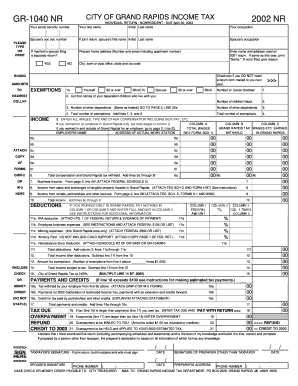

Filling out the MI GR-1040NR is an essential step for nonresidents earning income in Grand Rapids. This guide will provide clear and detailed instructions to help you complete the form accurately and efficiently using an online approach.

Follow the steps to complete your MI GR-1040NR online.

- Press the ‘Get Form’ button to access the MI GR-1040NR and open it in the editor.

- Begin by entering your first name and social security number in the designated fields. If you are filing a joint return, include your spouse's information as well.

- Provide your present home address, ensuring that you include the number, street, and any applicable apartment information.

- Indicate whether you are checking the box that states you do not require a return form mailed to you next year.

- In the exemptions section, indicate if you or your spouse are 65 or older or blind by checking the respective boxes.

- List your dependents' names and specify the total number for which you are claiming exemptions.

- Complete the income section by entering all wages, tips, and other compensation as required.

- If you have any deductions (such as IRA contributions or business expenses), fill those in according to the instructions provided for each line.

- Review your tax owed or refund due by calculating the total income subject to tax and applying the appropriate rates.

- Finally, after checking all entries for accuracy, save your changes, and choose whether to download, print, or share the completed form.

Complete your MI GR-1040NR online today to ensure accurate and timely filing!

Get form

You can file your MI 1040 tax forms, including the MI GR-1040NR, either electronically or by mail. For electronic filing, consider using certified online tax software that supports Michigan state taxes. If you opt for paper filing, send your completed forms to the appropriate address provided by the Michigan Department of Treasury. Uslegalforms helps ensure you have the correct filing information and forms for a successful submission.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.