Loading

Get Ny Ct-400-mn 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-400-MN online

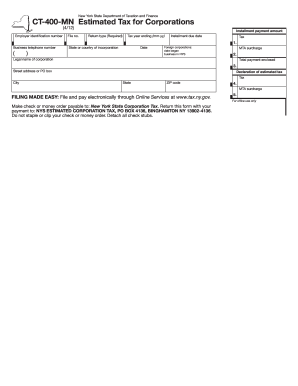

Filling out the NY CT-400-MN form is essential for corporations to report estimated taxes accurately. This guide will provide you with clear, step-by-step instructions on how to complete this form online effectively.

Follow the steps to fill out the NY CT-400-MN with ease.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, input your employer identification number, file number, and state or country of incorporation. Ensure accuracy to avoid issues.

- Next, enter the business telephone number, legal name of the corporation, and the street address or P.O. box. Complete the city, state, and ZIP code fields.

- For the MTA surcharge, indicate if applicable. Enter the total payment enclosed that reflects your calculated taxes.

Complete your documents online today to ensure timely submission.

Filling out the NY IT2104 involves providing your personal information, expected income, and any exemptions you wish to claim. This form helps determine your withholding tax for the year. It's crucial to ensure accuracy so that your estimated payments align with the requirements. You can also rely on guidance from U.S. Legal Forms to assist in filling out this form and related documents correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.