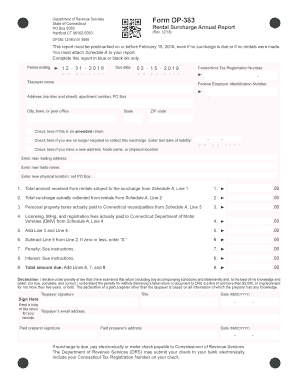

Get Ct Op-383 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT OP-383 online

How to fill out and sign CT OP-383 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax timeframe commenced unpredictably or perhaps you simply overlooked it, it might lead to difficulties for you.

CT OP-383 is not the simplest document, but there is no need for concern in any event.

Leveraging our advanced digital solution and its helpful tools, completing CT OP-383 becomes more efficient. Don’t hesitate to give it a try, allowing you to dedicate more time to hobbies and interests instead of document preparation.

- Access the document using our robust PDF editor.

- Input the required information in CT OP-383, utilizing fillable fields.

- Add images, checkmarks, tick boxes, and text areas if desired.

- Subsequent fields will auto-populate after the initial entry.

- If you encounter challenges, utilize the Wizard Tool to receive tips for easier submission.

- Always remember to include the filing date.

- Create your distinct electronic signature once and position it in all necessary locations.

- Review the details you’ve entered. Rectify any errors if needed.

- Click on Done to complete editing and choose your preferred method of submission. Options include virtual fax, USPS, or email.

- You can download the file to print later or upload it to cloud services like Dropbox, OneDrive, etc.

How to Modify Get CT OP-383 2018: Tailor Forms Online

Streamline your document preparation procedure and adjust it to your preferences with just a few clicks. Complete and authorize Get CT OP-383 2018 utilizing a robust yet intuitive online editor.

Document preparation can be challenging, particularly when it’s done infrequently. It requires strict adherence to all regulations and careful completion of all fields with accurate and complete information. However, it frequently happens that you need to alter the form or add additional fields to complete. If you need to revise Get CT OP-383 2018 before submission, the optimal method is to utilize our powerful yet easy-to-use online editing tools.

This all-encompassing PDF editing tool enables you to quickly and effortlessly complete legal documents from any device connected to the internet, make simple edits to the form, and add more fillable areas. The service allows you to specify a distinct area for each type of information, like Name, Signature, Currency, and SSN. You can designate these fields as mandatory or conditional and determine who is responsible for filling each field by assigning them to a certain recipient.

Follow the steps below to enhance your Get CT OP-383 2018 online:

Our editor is a versatile, feature-rich online solution that enables you to efficiently and swiftly enhance Get CT OP-383 2018 along with other documents in accordance with your specifications. Reduce document preparation and submission time and make your forms appear professional with ease.

- Access the required document from the directory.

- Complete the fields with Text and use Check and Cross tools for the tick boxes.

- Use the right-side panel to adjust the template by introducing new fillable areas.

- Select the areas based on the type of information you want to collect.

- Make these fields mandatory, optional, or conditional and arrange their sequence.

- Assign each section to a specified party using the Add Signer tool.

- Confirm that you’ve completed all necessary adjustments and click Done.

Get form

You can verify a CT resale certificate by checking with the Connecticut Department of Revenue Services, which maintains records of valid sellers. Ensure you request confirmation directly for accuracy. To simplify the verification process, CT OP-383 provides tools and insights that can streamline your search.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.