Loading

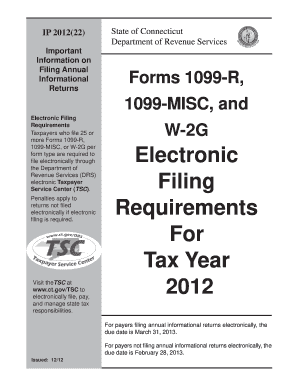

Get Ct Forms 1099-r 1099-misc And W-2g Electronic Filing Requirements 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT Forms 1099-R, 1099-MISC, and W-2G Electronic Filing Requirements online

This guide provides a comprehensive overview of how to fill out the CT Forms 1099-R, 1099-MISC, and W-2G for electronic filing. It aims to support users in navigating the electronic filing process with clarity and confidence.

Follow the steps to complete your forms accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general instructions provided in the form. Understand key information about the purposes of the forms and the filing requirements specific to Connecticut.

- Enter metadata at the top of the form including the year, payer’s identification number, and contact information as outlined in the instructions.

- Fill in the Payer’s account details, ensuring that the Payer’s TIN, name, and control codes are accurate.

- Record payee details accurately using the Payee B record structure, ensuring that tax identification numbers match the required formats.

- Complete the payment amounts for each type of return according to the instructions provided, ensuring all amounts are right justified and zero-filled if not applicable.

- Review all entries for accuracy. Check for errors in fields, especially TINs and payment amounts before proceeding.

- Once all information is filled and verified, save the document and prepare to submit it electronically via the designated electronic service.

- Submit the forms through the Taxpayer Service Center (TSC) by following the prompt options for either single employer or bulk filing as required.

- After submission, ensure to receive and keep the confirmation number issued by the TSC for your records.

Start filing your CT Forms 1099-R, 1099-MISC, and W-2G online today to ensure compliance and avoid any penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file 1099-R electronically through various IRS-approved platforms. Electronic filing simplifies the process and ensures compliance with CT Forms 1099-R 1099-MISC and W-2G Electronic Filing Requirements. This method significantly reduces the chances of error in your filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.