Get Ct Drs Schedule Ct-si 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS Schedule CT-SI online

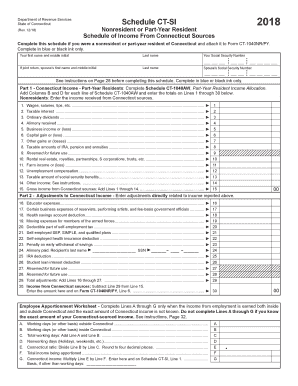

Filling out the CT DRS Schedule CT-SI is essential for nonresident or part-year residents of Connecticut to report their income from Connecticut sources. This guide will take you through each section of the form step-by-step, ensuring a clear understanding of what is required.

Follow the steps to complete the CT DRS Schedule CT-SI successfully.

- Press the ‘Get Form’ button to obtain the schedule, which will open in your preferred editor.

- In the first section, enter your first name and middle initial, followed by your last name. If you are filing a joint return, input your partner’s first name, middle initial, and last name as well.

- Fill in the Social Security numbers for both yourself and your partner (if applicable). Ensure accuracy as this information is crucial for processing.

- In Part 1, report your income from Connecticut sources. For nonresidents, include wages, salaries, dividends, and other earnings as indicated in each respective line. Add the totals from Lines 1 through 14 and enter this amount on Line 15.

- In Part 2, enter any adjustments related to your income. Complete the fields for educator expenses, self-employment taxes, and other adjustments as necessary. Total these adjustments and enter the final amount on Line 29.

- Subtract the total adjustments on Line 29 from your gross income on Line 15. The result should be entered on Line 30, which will be reported on Form CT-1040NR/PY.

- If applicable, complete the Employee Apportionment Worksheet—only if your income is earned both inside and outside Connecticut. Follow the directions for calculating the Connecticut income ratio.

- Once you've filled in all necessary sections, ensure all information is accurate, then save your changes. At this point, you can choose to download, print, or share the completed form.

Complete your CT DRS Schedule CT-SI online today to ensure compliance and accurate reporting of your Connecticut income.

Get form

Related links form

The CT business entity tax applies to certain business structures operating in Connecticut, including corporations and limited liability companies. If your business meets the criteria, you are responsible for filing and paying this tax annually. Being aware of this obligation ensures compliance and helps avoid penalties, as outlined in the related CT DRS Schedule CT-SI.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.