Loading

Get Ak Dor 6323 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 6323 online

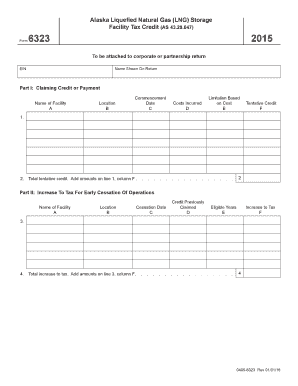

Filling out the AK DoR 6323 form is an essential step for individuals and organizations seeking to claim the Alaska liquefied natural gas storage facility tax credit. This guide provides clear and detailed instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the AK DoR 6323 form online.

- Click 'Get Form' button to access the AK DoR 6323 form and open it in your preferred digital editor.

- Enter your Employer Identification Number (EIN) in the designated field at the top of the form, as this is crucial for identification purposes.

- In the 'Name Shown On Return' field, provide the official name of the entity (corporation or partnership) submitting the form.

- For 'Part I: Claiming Credit or Payment', fill in the 'Name of Facility' and 'Location' fields with the relevant details regarding your liquefied natural gas storage facility.

- Input the 'Commencement Date' of your facility's operations in the specified format to establish when the operations began.

- In 'Costs Incurred', list the eligible costs associated with the facility; ensure you accurately total these costs for later use.

- For 'Limitation Based on Cost', provide the applicable limitations to calculate the tentative credit effectively.

- Compute the total tentative credit by adding amounts from column F under line 1, and ensure the figure is accurate.

- Proceed to 'Part II: Increase To Tax For Early Cessation Of Operations'; repeat the details for the facility including any cessation date if applicable.

- Submit any previous credits claimed and the eligible years for which you are applying the increase to tax.

- Calculate the increase to tax by summing the amounts on line 3, column F.

- After ensuring all information is complete and accurate, users can save changes, download the document, print it, or share the form as necessary.

Complete the AK DoR 6323 form online today to ensure you claim your benefits accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out an EZ tax form, start with your basic information, including your marital status and income sources. The form is designed to be straightforward, so refer to the AK DoR 6323 resources for help if needed. Following the guidelines ensures that you complete your form accurately and take advantage of any straightforward deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.