Loading

Get Ct Drs Ct-w3 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-W3 online

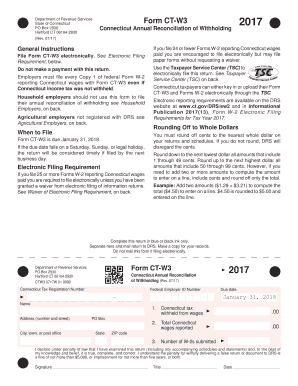

This guide provides comprehensive instructions for accurately completing the CT DRS CT-W3 form online. Designed for employers in Connecticut, it will help you ensure compliance and complete your annual reconciliation of withholding effectively.

Follow the steps to efficiently complete the CT DRS CT-W3 online.

- Press the ‘Get Form’ button to access the CT DRS CT-W3 form, opening it in your preferred online editor.

- Provide your Connecticut tax registration number and federal employer ID number at the designated fields on the form.

- Enter the due date for filing, which is January 31, 2018, ensuring it matches the requirements stipulated by the Department of Revenue Services.

- For Line 1, record the total Connecticut income tax withheld from wages during the 2017 calendar year. This amount should coincide with the total line on the back of the return.

- Fill in Line 2 with the total Connecticut wages reported for the calendar year 2017, ensuring to include all applicable wages paid to both residents and nonresidents of Connecticut.

- Indicate the number of W-2 forms you are submitting with the form by filling out Line 3.

- Certify your submission by signing and dating the form, affirming that all information provided is complete and correct.

- For electronic filing, ensure your W-2 forms are prepared and uploaded within the Taxpayer Service Center, if applicable while avoiding mention of mailing.

- Once completed, save changes, download, or print the document as needed for your records.

Start completing your CT DRS CT-W3 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A CT registration number is a unique identifier assigned by the Connecticut Department of Revenue Services for tax purposes. This number is essential for businesses operating in the state as it allows for streamlined tax reporting and compliance. When using platforms like uslegalforms, you can easily obtain assistance with registering your business and understanding your CT registration number.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.