Get Ct Drs Ct-706 Nt Ext 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-706 NT EXT online

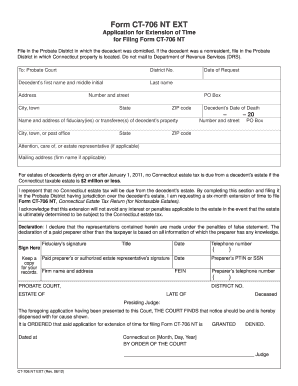

Filling out the CT DRS CT-706 NT EXT form is essential for requesting an extension of time to file the Connecticut Estate Tax Return for nontaxable estates. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete your application for an extension.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Fill in the name of the Probate Court to which the form is to be submitted.

- Enter the decedent’s first name, middle initial, last name, address, date of request, and date of death.

- Provide the name and address of the fiduciary or transferee of the decedent’s property, including additional relevant contact information.

- Indicate that no Connecticut estate tax will be due from the decedent’s estate and acknowledge that this extension will not avoid any interest or penalties.

- Sign the form in the designated area. The fiduciary’s signature and title must be included alongside the date and telephone number.

- If applicable, include the signature of a paid preparer or authorized estate representative, along with their details.

- Verify that all information is correctly entered, then submit the form to the Probate Court before the original due date of Form CT-706 NT.

- Once the form is filed, the Probate Court will process the application and grant or deny the extension as indicated.

Complete your application for an extension online now for efficient document management.

Get form

Inheritance rules in Connecticut include specifics on how estates are divided and the tax implications of those transfers. It is essential to follow both state laws and any applicable wills or trusts that dictate asset distribution. Using resources like UsLegalForms can help you understand these rules and ensure your estate plan is compliant with the CT DRS CT-706 NT EXT requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.