Get Ct Drs Ct-1120da 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1120DA online

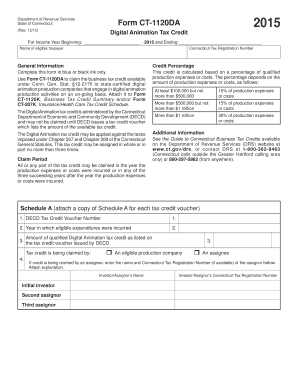

Filling out the CT DRS CT-1120DA form is an essential step for claiming the Digital Animation Tax Credit in Connecticut. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to correctly fill out the CT DRS CT-1120DA online.

- Select the 'Get Form' button to obtain the CT DRS CT-1120DA form and open it in your document editor.

- Enter the name of the eligible taxpayer and the Connecticut Tax Registration Number in the designated fields.

- Fill in the income year beginning and ending dates to specify the claim period.

- In Schedule A, include the DECD Tax Credit Voucher Number and the year in which the eligible expenditures were incurred.

- Indicate the amount of qualified Digital Animation tax credit as listed on the DECD tax credit voucher.

- Select whether the credit is being claimed by the eligible production company or an assignee and provide the necessary details if claiming as an assignee.

- Move to the Credit Computation section and complete the details for the total credits earned for the years provided.

- Calculate and enter the credits applied and available for each relevant year, ensuring the totals are accurate.

- Review all entries for accuracy before you save your changes, download, print, or share the completed form as required.

Begin filling out your form online today to claim your Digital Animation Tax Credit.

Get form

Related links form

When filling out a CT bill of sale, include the buyer's and seller's details, along with a thorough description of the item being sold. It’s essential to reference the CT DRS CT-1120DA for any specific requirements that apply to your transaction. Including terms and consideration can provide clarity and protection for both parties. For assistance, our platform has resources that can help you complete this document efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.