Loading

Get Ct Drs Ct-1120 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1120 online

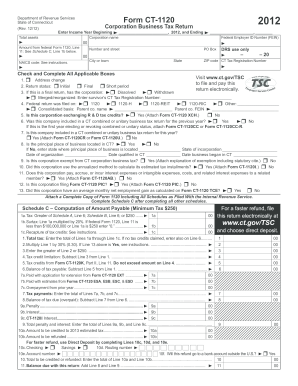

The CT DRS CT-1120 is a critical document for corporations in Connecticut to file their business tax returns. This guide provides step-by-step instructions to help you efficiently complete the form online, ensuring that you meet all requirements and deadlines.

Follow the steps to complete your CT DRS CT-1120 online.

- Click ‘Get Form’ button to obtain the CT DRS CT-1120 form and open it in your editor.

- Enter the income year beginning and ending. This information is essential for the processing of your return.

- Fill in the corporation name, Federal Employer ID Number (FEIN), and address details, including city, state, and ZIP code.

- Check the applicable boxes regarding address changes, return status, and other specific questions about the corporation's status.

- Complete Schedule C after filling out the necessary information on other schedules, particularly focusing on the computation of the amount payable.

- Input details into Schedules A, B, D, and E as applicable, following the computations for tax on net income and minimum tax on capital.

- Make sure to attach all required documents and forms, including any additional schedules as needed, before finalizing your return.

- Review all entries for accuracy, and ensure that all applicable information is provided to avoid delays.

- Once completed, save your changes, and choose to download, print, or share the form as necessary.

Complete your CT DRS CT-1120 form online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filing the CT-1120 late can result in significant penalties and interest on the amount due. The Connecticut Department of Revenue Services imposes these penalties to encourage timely filing. Avoiding late fees is easy when you plan ahead and use available tools. With resources like UsLegalForms, you can streamline the filing process and ensure you meet deadlines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.