Loading

Get Ct Drs Ct-1041 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1041 online

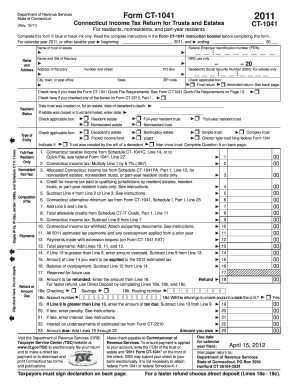

This guide provides clear, step-by-step instructions for completing the CT DRS CT-1041 form, which is the Connecticut Income Tax Return for Trusts and Estates. Whether you are a resident, nonresident, or part-year resident, this comprehensive resource will help you navigate the process of filing your form online efficiently.

Follow the steps to complete your CT DRS CT-1041 form online.

- Press the ‘Get Form’ button to acquire the CT DRS CT-1041 form and open it.

- Fill in the appropriate dates for the taxable year at the beginning of the form. Ensure the dates reflect the calendar year or other specified taxable year.

- Provide the name of the trust or estate as well as the Federal Employer Identification Number (FEIN) in the specified fields.

- Enter the name and title of the fiduciary. Follow this by including the fiduciary's full address, including city, state, and ZIP code.

- For estates only, input the decedent’s Social Security Number (SSN) in the designated area. Make sure the SSN is accurate.

- Select whether this form is a final return, an amended return, or if it qualifies for the Quick-File requirements by checking the applicable boxes.

- Indicate the date the trust was created or, for an estate, the date of the decedent’s death. If applicable, enter the date of trust termination or estate closure.

- Attach all necessary documentation, including W-2s, W-2Gs, and certain 1099s, to the form in the designated areas, ensuring compliance.

- Complete the sections for Connecticut taxable income, computation of tax, and allowable credits, as detailed in the form. Be thorough to avoid errors.

- For refunds, fill in the direct deposit information if seeking faster processing. Confirm that all requested information is accurate before submission.

- After reviewing all entries for accuracy, save your changes and choose to download, print, or share your completed form as needed.

Complete your CT DRS CT-1041 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The threshold for filing estate 1041 generally depends on the estate's income, property value, and related factors. Understanding the criteria set by CT DRS CT-1041 is crucial to determine your filing obligations. Consulting a tax professional may also provide valuable insights.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.