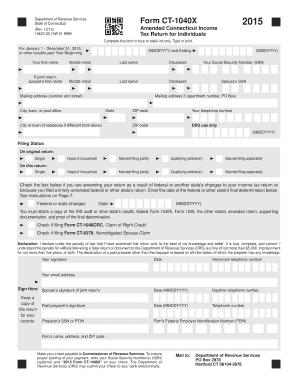

Get Ct Drs Ct-1040x 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-1040X online

How to fill out and sign CT DRS CT-1040X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or you simply overlooked it, it could likely cause issues for you. CT DRS CT-1040X is not the most straightforward form, but there is no need for alarm in any case.

By using our robust solution, you will grasp the optimal method to complete CT DRS CT-1040X even in circumstances of significant time constraints. The only thing you need to do is adhere to these basic instructions:

With our effective digital solution and its professional tools, filling out CT DRS CT-1040X becomes more convenient. Do not hesitate to try it and dedicate more time to hobbies and interests instead of preparing paperwork.

Access the document in our advanced PDF editor.

Provide the required information in CT DRS CT-1040X, using fillable fields.

Add images, marks, checkboxes, and text boxes, if necessary.

Repeated information will be inserted automatically after the initial entry.

If you encounter any challenges, utilize the Wizard Tool. You will receive helpful hints for more straightforward completion.

Always remember to include the application date.

Create your unique electronic signature once and insert it in all necessary fields.

Review the information you have provided. Amend any errors if needed.

Click on Done to complete editing and select the method of submission. You will have the option to use virtual fax, USPS, or email.

You can also download the document for later printing or upload it to cloud storage services like Google Drive, Dropbox, etc.

How to modify Get CT DRS CT-1040X 2015: personalize forms online

Complete and endorse your Get CT DRS CT-1040X 2015 swiftly and flawlessly. Access and modify, and endorse adaptable form samples from the convenience of a single tab.

Your document management can be significantly more effective if everything required for altering and managing the process is organized in one location. If you are looking for a Get CT DRS CT-1040X 2015 form sample, this is the ideal place to obtain it and complete it without seeking out external solutions. With this advanced search engine and editing tool, you won’t need to search any further.

Simply enter the title of the Get CT DRS CT-1040X 2015 or any other form and locate the appropriate sample. If the sample appears to be pertinent, you can begin altering it immediately by clicking Get form. There is no requirement to print or even download it. Hover and click on the interactive fillable areas to input your information and sign the form in a single editor.

Utilize additional editing tools to personalize your form: Check interactive tick boxes in forms by clicking on them. Review other sections of the Get CT DRS CT-1040X 2015 form text with the aid of the Cross, Check, and Circle tools.

Store the form on your device or convert its format to your desired one. When furnished with an intelligent forms catalog and a robust document modification solution, handling documentation becomes simpler. Locate the form you need, complete it immediately, and endorse it on the spot without downloading. Simplify your paperwork routine with a solution designed for altering forms.

- If you wish to add more textual information to the document, use the Text tool or include fillable fields with the appropriate button.

- You may also define the content of each fillable field.

- Incorporate images into forms using the Image button. Add images from your device or capture them with your computer's camera.

- Insert custom graphical elements into the document. Utilize Draw, Line, and Arrow tools to annotate the document.

- Write over the text in the document if you need to obscure or emphasize it. Conceal text segments with the Erase, Highlight, or Blackout tool.

- Include custom elements such as Initials or Date with the corresponding tools. These will be generated automatically.

Get form

Related links form

The IRS typically allows you to set up a payment plan for up to 72 months, depending on the amount owed. However, it's best to check the specifics of your situation, as various conditions can apply. Knowing your options can aid in managing your tax liabilities effectively, and if you need to address past returns, the CT DRS CT-1040X can assist in making the necessary adjustments.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.