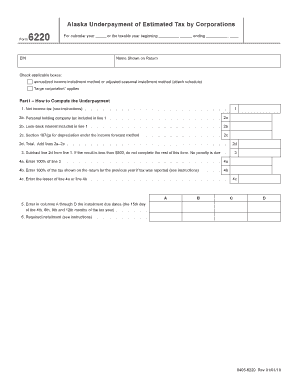

Get Ak Dor 6220 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK DoR 6220 online

How to fill out and sign AK DoR 6220 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period commenced unexpectedly or you simply overlooked it, it might lead to issues for you.

AK DoR 6220 is not the simplest form, but you have no need for concern in any circumstance.

Utilizing our powerful digital solution and its helpful tools, completing AK DoR 6220 becomes easier. Do not hesitate to use it and enjoy more time on hobbies and interests instead of document preparation.

- Open the document with our robust PDF editor.

- Complete all the necessary information in AK DoR 6220, using fillable fields.

- Add images, marks, checkboxes, and text fields, if applicable.

- Repeated information will be entered automatically after the initial input.

- In case of difficulties, activate the Wizard Tool. You will receive some guidance for a smoother submission.

- Remember to insert the date of application.

- Create your distinct e-signature once and place it in all required locations.

- Verify the details you have provided. Rectify errors if necessary.

- Click Done to finalize the editing and select how you wish to send it. You will have the option to use digital fax, USPS, or electronic mail.

- You can download the file to print it later or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to modify Get AK DoR 6220 2019: personalize forms digitally

Experience the convenience of the feature-rich online editor while finalizing your Get AK DoR 6220 2019. Utilize the array of instruments to quickly fill in the gaps and submit the required information promptly.

Creating documents can be time-consuming and expensive unless you possess pre-prepared fillable forms and complete them electronically. The optimal method to handle the Get AK DoR 6220 2019 is to employ our professional and versatile online editing tools. We equip you with all the essential instruments for rapid form completion and enable you to modify any templates to suit specific requirements. Furthermore, you can provide feedback on the alterations and append notes for other participants involved.

Here’s what you are capable of doing with your Get AK DoR 6220 2019 in our editor:

Managing the Get AK DoR 6220 2019 in our robust online editor is the fastest and most efficient method to organize, submit, and share your documentation as per your needs from any place. The tool functions from the cloud, enabling you to access it from any location on any internet-enabled device. All templates you create or complete are securely stored in the cloud, ensuring constant accessibility without the risk of loss. Stop spending time on traditional document completion and eliminate paper; accomplish everything online with minimal effort.

- Fill the empty fields using Text, Cross, Check, Initials, Date, and Sign instruments.

- Emphasize crucial details with your chosen color or underline them.

- Hide sensitive information using the Blackout feature or simply erase them.

- Insert images to illustrate your Get AK DoR 6220 2019.

- Swap the original text with one that meets your needs.

- Add remarks or sticky notes to discuss updates with others.

- Create additional fillable fields and designate them to specific individuals.

- Safeguard the template with watermarks, include dates, and bates numbers.

- Distribute the document in multiple ways and store it on your device or the cloud in various formats post-adjustment.

Related links form

Massachusetts has a statewide sales tax rate of 6.25%. This rate applies uniformly across most goods and services, providing consistency for businesses and consumers. However, laws and taxes can change, so refer to the AK DoR 6220 for additional insights into differing state tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.