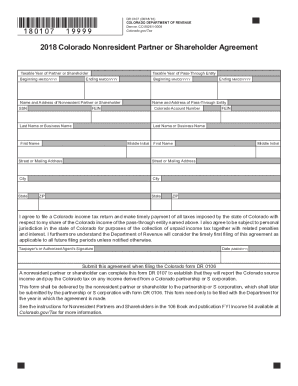

Get Co Dor 106 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO DoR 106 online

How to fill out and sign CO DoR 106 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you. CO DoR 106 isn't the most straightforward form, but there’s no need for alarm in any instance.

By employing our expert solution, you will grasp the optimal method to complete CO DoR 106 in times of significant time constraints. You merely need to adhere to these fundamental instructions:

With our comprehensive digital solution and its useful tools, filling out CO DoR 106 becomes more convenient. Do not hesitate to try it out and allocate more time to your interests rather than document preparation.

Access the document with our sophisticated PDF editor.

Input all necessary information in CO DoR 106, utilizing fillable fields.

Add images, crosses, check marks, and text boxes, if desired.

Repetitive information will be populated automatically after the initial entry.

If you encounter any confusion, activate the Wizard Tool. You will receive suggestions for easier completion.

Remember to include the application date.

Design your unique signature once and position it in all required areas.

Review the information you have entered. Amend errors if necessary.

Select Done to complete modifications and choose how you will submit it. You can opt for virtual fax, USPS, or email.

You can download the document for later printing or upload it to a cloud service such as Dropbox, OneDrive, etc.

How to modify Get CO DoR 106 2018: personalize forms online

Provide the appropriate document modification tools at your disposal. Complete Get CO DoR 106 2018 with our dependable service that includes editing and eSignature capabilities.

If you wish to execute and endorse Get CO DoR 106 2018 online effortlessly, then our web-based cloud solution is the perfect option. We present an extensive template-based library of ready-to-edit documents that you can alter and finish online. Furthermore, there is no requirement to print the form or utilize third-party services to make it fillable. All necessary tools will be immediately accessible for your convenience as soon as you open the document in the editor.

Modify and annotate the template

The top toolbar includes the tools that assist you in emphasizing and obscuring text, without visuals and image components (lines, arrows, and checkmarks, etc.), sign, initial, date the document, and more.

Arrange your documents Use the toolbar on the left if you wish to reorder the document or remove pages.

- Inspect our online editing tools and their essential features.

- The editor includes a user-friendly interface, so it won't take long to master how to use it.

- We'll look at three main sections that enable you to:

Get form

Filing a protest with the Colorado Department of Revenue involves submitting a formal notice, as mentioned previously, citing the grounds for your protest. This must be done within a specific time frame, often within 30 days of the notice received. Utilizing resources like uslegalforms can guide you through the requirements of CO DoR 106 as you file your protest.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.