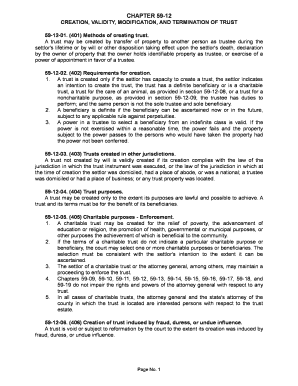

Get Nd Chapter 59-12 Creation Validity Modification And Termination Of Trust 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ND Chapter 59-12 Creation Validity Modification And Termination Of Trust online

Completing the ND Chapter 59-12 Creation Validity Modification And Termination Of Trust online is an essential process for ensuring that your trust is established, modified, or terminated correctly. This guide provides clear steps to help you navigate through the form and understand its components, ensuring your legal intentions are accurately represented.

Follow the steps to fill out the ND Chapter 59-12 online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Review the instructions provided on the form before starting to fill out any information. Understanding the purpose of each section will help you complete the form more accurately.

- Enter your personal details as the settlor. This includes your name, address, and contact information. Ensure all information is correct and current.

- Specify the methods of creating the trust. Indicate whether the trust is being created during your lifetime, through a will, by declaration, or through the exercise of a power of appointment.

- Identify the intended beneficiaries. Clearly define who will benefit from the trust. This could include individuals, organizations, or a charitable purpose.

- Outline the duties and powers of the trustee. State who will act as trustee and detail their responsibilities in managing the trust.

- Include information regarding the modification or termination of the trust. Specify any conditions under which the trust can be altered or ended.

- Review all the information entered in the form to ensure accuracy. Corrections made before submission can save you time.

- Once satisfied, save your changes. Depending on your need, you can download, print, or share the completed form electronically.

Start completing your documents online today to ensure your intentions are legally recognized.

The tax consequences of terminating a trust can vary based on the trust's structure and how the assets are distributed, according to ND Chapter 59-12 Creation Validity Modification And Termination Of Trust. Beneficiaries might face income tax implications on distributions, and the trust itself may need to file a final tax return. Consulting a tax advisor is essential to understand all potential tax liabilities before proceeding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.