Loading

Get Wi Be-005 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI BE-005 online

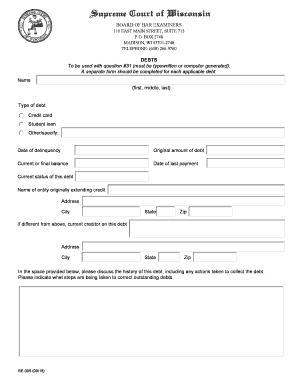

Filling out the WI BE-005 form is an essential part of disclosing your financial obligations. This guide provides comprehensive instructions to help you accurately complete the form online, ensuring all necessary details are captured effectively.

Follow the steps to complete the WI BE-005 online form.

- Press the ‘Get Form’ button to access the form. This will allow you to open the document in your preferred editing tool.

- In the first section, fill in your name, including your first, middle, and last names, making sure each name is clearly typed.

- Indicate the type of debt you are disclosing by selecting one of the options provided: credit card, student loan, or other. If you select 'other,' please specify the type of debt.

- Provide the date of delinquency related to the debt. This should be the date when the payment was missed or the debt became delinquent.

- Input the original amount of the debt. This is the total amount owed at the time the debt was incurred, before any payments or interest.

- Specify the current or final balance of the debt, which is the amount still owed or any remaining balance after payments have been made.

- Enter the date of the last payment made towards this debt, ensuring that the information is accurate.

- Select the current status of this debt to indicate whether it is still active, paid off, or in another status.

- List the name of the entity that originally extended credit to you. This is the financial institution or lender that provided the loan or credit initially.

- Complete the address details for the original creditor, including city, state, and zip code to ensure clear identification.

- If the current creditor of the debt is different from the original creditor, please provide their name and address information in the designated fields.

- Utilize the space provided to discuss the history of this debt, detailing any actions taken to collect it and your response to these actions.

- Conclude by indicating what steps you are taking to correct the outstanding debts, showcasing your commitment to resolving the issue.

- Once all fields are accurately filled out, save your changes to the form. You may have options to download, print, or share the completed document.

Complete your documents online to ensure a smooth filing process.

Services in Massachusetts are generally not taxable. But watch out if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Massachusetts , with a few exceptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.