Get Or Doj Rf-c 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DOJ RF-C online

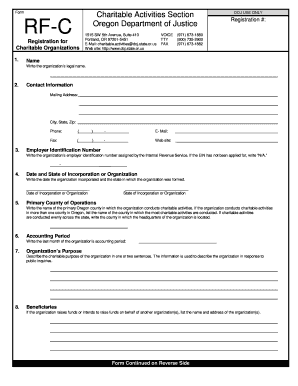

This guide provides clear and concise instructions for completing the OR DOJ RF-C form, essential for organizations seeking to register their charitable activities in Oregon. Whether you are familiar with legal documents or not, this step-by-step approach will simplify the process.

Follow the steps to effectively complete the OR DOJ RF-C form.

- Press the ‘Get Form’ button to acquire the OR DOJ RF-C form and open it in the editor.

- In the first section, enter the organization's legal name in the designated field.

- Provide the mailing address, including all relevant details, in the contact information section.

- Enter the organization's phone number and email address, along with the fax number if applicable.

- Fill in the Employer Identification Number (EIN) assigned by the IRS, or write 'N/A' if it has not been applied for.

- Record the date of incorporation and the state where the organization was formed.

- Identify the primary Oregon county where the organization conducts most of its charitable activities.

- Indicate the last month of the accounting period for the organization.

- Describe the organization's charitable purpose succinctly in one or two sentences.

- If applicable, list the names and addresses of other organizations on behalf of which funds are raised.

- Select the appropriate box to indicate the organization’s tax-exempt status with the IRS.

- Answer if the organization is involved in any joint fundraising efforts, providing names where relevant.

- Confirm if the organization conducts any charitable gaming activities such as bingo or raffles.

- Provide the contact information for an individual who can answer questions regarding the registration.

- List the names and positions of officers, directors, trustees, and key employees of the organization.

- Attach all required documents to the registration form, including IRS letters, incorporation articles, and bylaws.

- Sign and date the form where indicated, ensuring all information is complete and accurate.

- Once all edits are complete, save changes, download, print, or share the filled form as necessary.

Start completing your OR DOJ RF-C registration form online today to ensure compliance and facilitate your charitable activities.

Starting a charity in Tennessee involves clear planning and execution. Begin by establishing a mission, then form a board of directors to help guide the organization. After incorporating your charity with the state, you must apply for federal tax-exempt status. Resources like the OR DOJ RF-C can provide valuable information to help you through each step.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.