Get Oh Request For Payoff Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Request for Payoff Information online

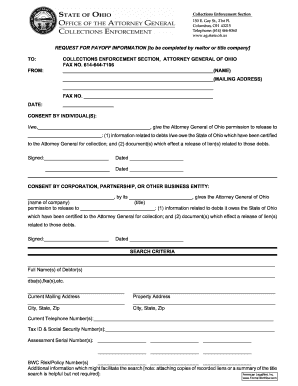

The OH Request for Payoff Information is a critical document used by realtors and title companies to obtain information about debts owed to the State of Ohio. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth process.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the OH Request for Payoff Information form and open it in your editor.

- Begin by entering the name and mailing address of the individual or business requesting the payoff information in the designated fields.

- Fill in the fax number where the information should be sent. Ensure that this number is accurate to avoid communication delays.

- In the consent section, clearly state the individual or business granting permission for their information to be released. Make sure to include the names and signatures of all individuals involved, alongside the date.

- Provide the search criteria including the full names of the debtors, any relevant ‘doing business as’ names (dba), the current mailing address, and property address details.

- Enter current telephone numbers, tax identification numbers, social security numbers, assessment serial numbers, and BWC risk/policy numbers as required in the respective fields.

- If applicable, include any additional information that might assist the search, such as attachments of recorded liens or summaries of title searches.

- Once all sections are accurately completed, review the document carefully for any omissions or errors.

- After confirmation of accuracy, options to save changes, download, print, or share the completed form will be available to facilitate submission.

Complete your OH Request for Payoff Information form online today for a hassle-free experience.

Requesting a payoff amount means you are asking for the total sum required to fully settle your mortgage. This figure, part of the OH Request for Payoff Information, includes the remaining principal, interest, and any additional fees. Knowing this amount is essential for making informed decisions about selling or refinancing your property. It allows you to budget effectively and understand your financial obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.