Get Nh Format For Creditor Matrix

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH Format for Creditor Matrix online

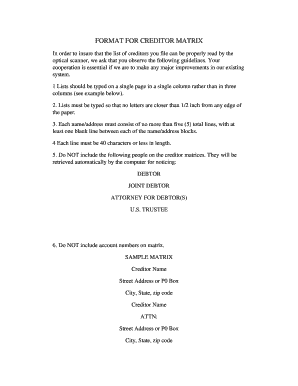

The NH Format for Creditor Matrix requires careful attention to ensure that your list of creditors is accurately processed. This guide provides a step-by-step approach to filling out the form online, ensuring that all necessary components are correctly formatted and submitted.

Follow the steps to accurately complete your creditor matrix online.

- Press the ‘Get Form’ button to obtain the NH Format for Creditor Matrix and open it in an editor.

- Type your creditor list on a single page in a single column format. Avoid using a multi-column layout, as it may hinder readability.

- Ensure no letters are closer than half an inch from the edges of the paper to maintain clear margins.

- Each entry in your list must be limited to five lines. Be sure to leave at least one blank line between each creditor's name and address block.

- Limit each line of the name/address to no more than 40 characters to conform to the scanning hardware requirements.

- Do not include the following individuals in your creditor matrix as they will be automatically retrieved: Debtor, Joint Debtor, Attorney for Debtor(s), and U.S. Trustee.

- Avoid listing account numbers in the matrix to ensure compliance with submission guidelines.

- Where applicable, type the creditor's zip code on the last line of the address block, formatting it as a nine-digit number separated by a hyphen.

- After completing the form, review it for accuracy. Make sure to avoid any stray marks or unnecessary lines.

- Save your changes, and if necessary, download, print, or share the completed NH Format for Creditor Matrix.

Complete your NH Format for Creditor Matrix online today to ensure your submission is accurate and efficient.

Several factors may disqualify you from filing for bankruptcy, including prior dismissals of your bankruptcy cases or failing to complete a required credit counseling course. It's crucial to understand the legal implications of bankruptcy eligibility. To assess your situation accurately, consider consulting legal resources or using services from US Legal Forms that clarify these nuances.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.