Get Mo Mcc 15-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

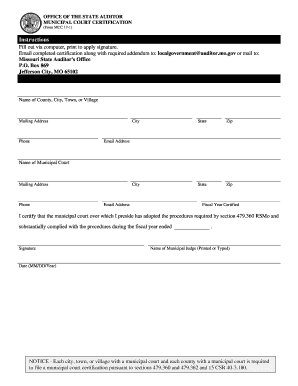

Tips on how to fill out, edit and sign MO MCC 15-1 online

How to fill out and sign MO MCC 15-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

While submitting legal paperwork is generally a demanding and time-consuming task, you can simplify the process by utilizing the US Legal Forms platform. It provides you with the MO MCC 15-1 and navigates you through the entire procedure, allowing you to feel confident about properly completing it.

Follow the instructions to fill out MO MCC 15-1:

Complete MO MCC 15-1 on US Legal Forms from anywhere and on any device.

- Access the document via the feature-rich online editor to begin filling it out.

- Look for the green arrow on the left side of your webpage, which offers a hint of the fields you need to complete marked with the text Fill.

- After entering the required information, the label on the green arrow will change to Next. Clicking it will take you to the subsequent fillable field, helping you avoid missing any sections.

- Authenticate the form using the e-signing tool. You can draw, type, or upload your signature, depending on what works best for you.

- Choose Date to input the current date on the MO MCC 15-1. This should happen automatically.

- If desired, review the suggestions and tips to ensure that you have not overlooked anything crucial and to verify the format.

- Once you have completed the template, click Done.

- Download the form to your device.

How to modify Get MO MCC 15-1: personalize forms online

Place the appropriate document editing tools at your disposal. Complete Get MO MCC 15-1 using our dependable tool that offers editing and eSignature capabilities.

If you seek to finalize and validate Get MO MCC 15-1 online effortlessly, then our web-based cloud solution is the ideal choice. We offer a rich library of customizable templates that you can alter and finalize online. Furthermore, there's no need to print the document or utilize external solutions to make it fillable. All necessary tools will be at your fingertips the moment you access the file in the editor.

Let’s explore our online editing tools and their key functionalities. The editor features a user-friendly interface, ensuring that it won’t take much time to master how to use it. We will examine three primary sections that enable you to:

In addition to the features mentioned earlier, you can safeguard your file with a password, incorporate a watermark, convert the file to the required format, and much more.

Our editor makes altering and certifying the Get MO MCC 15-1 an effortless task. It empowers you to accomplish nearly everything related to document management. Furthermore, we consistently ensure that your experience in modifying documents is secure and adheres to primary regulatory standards. All these elements contribute to making our solution more enjoyable.

Acquire Get MO MCC 15-1, implement the necessary modifications and adjustments, and download it in your preferred file format. Give it a try today!

- Alter and annotate the template

- The primary toolbar includes tools that assist you in highlighting and obscuring text, without graphics and image elements (lines, arrows, checkmarks, etc.), adding your signature, initializing, dating the form, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the form and/or remove pages.

- Prepare them for distribution

- If you intend to make the template fillable for others and share it, you can use the tools on the right and insert various fillable fields, signature and date, text box, etc.

Related links form

Your Mortgage Certificate Number isn't on Form 1098; it's found on a Mortgage Credit Certificate (MCC). ... If you only received a Form 1098 for the interest that you paid on your mortgage, and not a Mortgage Credit Certificate, you can' claim the Mortgage Interest Credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.