Loading

Get Mi Dissolution Questionnaire 2001-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Dissolution Questionnaire online

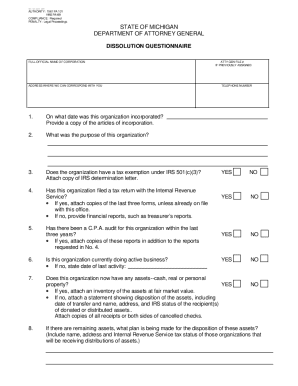

The MI Dissolution Questionnaire is a vital document for Michigan nonprofit corporations seeking to dissolve. This guide provides a clear, step-by-step approach to completing the form online, ensuring you have all the necessary information to submit your application effectively.

Follow the steps to complete the MI Dissolution Questionnaire online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the full official name of the corporation as registered.

- Provide the address where correspondence regarding the dissolution can be sent.

- Indicate the date when the organization was incorporated and attach a copy of the articles of incorporation.

- Describe the purpose of the organization in detail.

- Answer whether the organization has an IRS tax exemption under 501(c)(3) and if so, attach the determination letter.

- State whether the organization has filed a tax return with the IRS, provide supporting documentation as required based on the answer.

- Answer if there has been a CPA audit in the past three years and attach the reports if applicable.

- Indicate whether the organization is currently conducting active business and provide the date of last activity if not.

- Determine if the organization currently holds any assets. If yes, attach an inventory of these assets at fair market value; if no, provide a statement regarding the disposition of these assets.

- Explain the plan for disposing of any remaining assets and provide information on recipients.

- Confirm whether the recipients mentioned are aware of the intended use for the assets.

- State if the organization has any debts or obligations and provide documentation accordingly.

- Identify who will retain the books and records of the organization.

- Under penalty of perjury, certify the accuracy of the information by signing the document.

- Once all fields are completed, save changes, download, print, or share the form as necessary.

Complete your MI Dissolution Questionnaire online today to ensure a smooth dissolution process.

Related links form

Closing a non-profit with the IRS requires careful attention to detail, as outlined in the MI Dissolution Questionnaire. Begin by notifying the IRS of your intent to dissolve your organization. Next, file the final tax returns and ensure any remaining assets are properly distributed. Completing these steps helps maintain compliance and avoids future tax issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.