Get Mi B20a 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI B20A online

How to fill out and sign MI B20A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

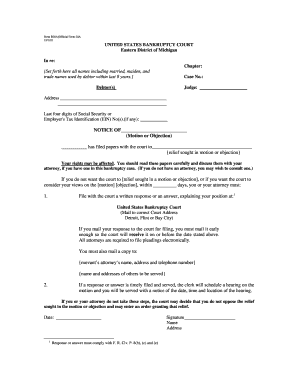

Although the process of filing legal documents can be a stressful and monotonous task, there exists a straightforward way to accomplish this with the assistance of the US Legal Forms platform. It will supply you with the MI B20A and support you throughout the entire process, ensuring you feel confident about the prompt and accurate completion.

Adhere to the steps for filling out MI B20A:

Complete MI B20A on US Legal Forms even while on the move and from any device.

- Initiate by accessing the document using the advanced online editor to commence filling it out.

- Follow the green arrow on the left side of the page. It will indicate the fields you need to complete with a label stating Fill.

- As you enter the required information, the label on the green arrow will shift to Next. Clicking it will navigate you to the subsequent field. This will guarantee that you do not overlook any sections.

- Sign the document using the e-signing tool. You can draw, type, or upload your signature, whichever method you prefer.

- Choose Date to input the current date on the MI B20A, which will likely be done automatically.

- Optionally review the guidelines and suggestions to ensure that you have not overlooked any crucial details and verify the document.

- For those who have completed the form, click Done.

- Download the document to your device.

How to Modify Get MI B20A 2010: Personalize Forms Online

Take advantage of the user-friendly nature of the versatile online editor while finishing your Get MI B20A 2010. Utilize the selection of tools to quickly fill in the gaps and supply the necessary information in no time.

Creating documentation can be labor-intensive and expensive unless you utilize pre-made fillable templates and complete them digitally. The easiest method to handle the Get MI B20A 2010 is to employ our expert and multifunctional online editing tools. We offer you all the essential instruments for fast form filling and enable you to make any modifications to your templates, tailoring them to any requirements. Moreover, you can comment on the updates and leave notes for other individuals involved.

Here’s what you are able to do with your Get MI B20A 2010 in our editor:

Utilizing Get MI B20A 2010 in our robust online editor is the fastest and most efficient way to handle, submit, and share your documents exactly as you need from any location. The tool operates from the cloud allowing access from any internet-enabled device. All templates you create or refine are securely stored in the cloud, ensuring you can always retrieve them when necessary without fear of loss. Stop squandering time on manual document completion and eliminate physical paperwork; accomplish everything online with minimal effort.

- Fill in the gaps using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize key details with a chosen color or underline them.

- Mask sensitive information using the Blackout feature or simply delete them.

- Insert images to illustrate your Get MI B20A 2010.

- Replace the original text with one that meets your needs.

- Include comments or sticky notes to update others on the changes.

- Remove unnecessary fillable fields and assign them to specific recipients.

- Safeguard the document with watermarks, add dates, and bates numbers.

- Distribute the document in various ways and save it to your device or the cloud in multiple formats once you complete the modifications.

Related links form

In Michigan, any individual with income above certain thresholds is required to file an income tax return. This includes wages, business income, and other earnings. Familiarizing yourself with the MI B20A regulations can help clarify your obligations. If you're unsure, reviewing your tax situation with a professional can provide peace of mind regarding your filing requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.