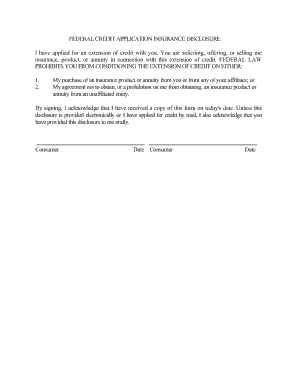

Get Federal Credit Application Insurance Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Federal Credit Application Insurance Disclosure online

How to fill out and sign Federal Credit Application Insurance Disclosure online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

While submitting legal documents is generally a demanding and monotonous undertaking, it offers an opportunity to complete them effortlessly with the US Legal Forms platform.

It supplies you with the Federal Credit Application Insurance Disclosure and guides you throughout the entire procedure, ensuring that you feel confident about timely and accurate completion.

Fill out the Federal Credit Application Insurance Disclosure on US Legal Forms even while on the move and from any device.

- Launch the form using the comprehensive online editor to begin filling it out.

- Follow the green arrow on the left side of the webpage. It will highlight the fields you need to complete with the label Fill.

- Once you enter the required information, the label on the green arrow will change to Next. Clicking it will take you to another fillable field, ensuring that you do not overlook any sections.

- Sign the document using the e-signing feature. Draw, type, or scan your signature, depending on what works best for you.

- Click on Date to enter the current date on the Federal Credit Application Insurance Disclosure. This will likely be done automatically.

- Optionally review the suggestions and advice to ensure that you haven't overlooked anything important; double-check the document.

- When you have completed the document, click Done.

- Download the file to your device.

How to modify Get Federal Credit Application Insurance Disclosure: personalize documents online

Utilize our extensive editor to convert a straightforward online template into a finalized document. Continue reading to discover how to alter Get Federal Credit Application Insurance Disclosure online effortlessly.

Once you locate a suitable Get Federal Credit Application Insurance Disclosure, your only task is to modify the template according to your tastes or legal stipulations. Besides completing the fillable form with precise information, you may need to eliminate certain provisions in the document that do not pertain to your situation. Conversely, you might wish to insert any absent conditions in the original form. Our sophisticated document editing tools offer the simplest method to amend and modify the document.

The editor allows you to alter the content of any document, even if the file is in PDF format. You can add or remove text, incorporate fillable fields, and implement further modifications while preserving the original formatting of the document. Additionally, you can rearrange the order of the pages within the form.

You do not have to print the Get Federal Credit Application Insurance Disclosure to provide your signature. The editor includes electronic signature functionalities. Most forms already contain signature fields. Thus, you only need to include your signature and request one from the other party needing to sign via email.

Adhere to this step-by-step guide to complete your Get Federal Credit Application Insurance Disclosure:

After all parties have signed the document, you will obtain a signed copy that you can download, print, and distribute to others.

Our services help you save significant amounts of time and minimize the likelihood of errors in your documents. Optimize your document workflows with efficient editing tools and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to modify the template to your liking.

- Complete the form with accurate information.

- Click on the signature field to insert your eSignature.

- If needed, forward the document for signatures from additional signers.

Related links form

The purpose of a disclosure form is to provide clear and crucial information regarding the specifics of a transaction or agreement. In the context of insurance, it ensures that clients are aware of what they are agreeing to before entering into a contract. This level of clarity fosters trust and accountability between parties. By using the Federal Credit Application Insurance Disclosure, you can ensure that all necessary information is readily available.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.