Get B3b 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign B3B online

How to fill out and sign B3B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Although completing legal documents is typically a stressful and time-consuming undertaking, there is an opportunity to fill them out easily by utilizing the US Legal Forms platform. It provides you with the B3B and guides you throughout the entire process, ensuring you feel confident about the proper submission.

Adhere to the instructions to complete the B3B:

Complete the B3B on US Legal Forms from anywhere and on any device.

- Access the document using the versatile online editor to begin completing it.

- Follow the green arrow located on the left side of the screen. It will indicate the fields that you need to fill in with the label Fill.

- Once you enter the required information, the label on the green arrow may change to Next. When you click it, you will be taken to another fillable field. This will guarantee that you won't overlook any fields.

- Sign the document using the e-signature tool. You can draw, type, or upload your signature, depending on your preference.

- Click Date to automatically insert the current date on the B3B.

- Optionally, review the tips and hints to ensure that you haven't omitted anything crucial and inspect the sample.

- If you have completed the form, press Done.

- Download the document to your device.

How to Alter Get B3B 2011: Personalize Forms Online

Eliminate the clutter from your documentation workflow. Uncover the most efficient method to locate, adjust, and submit a Get B3B 2011.

The task of preparing Get B3B 2011 requires precision and focus, particularly for those who are not very acquainted with such a role. It is crucial to obtain an appropriate template and populate it with the accurate details. With the right tools for document handling, you can have everything you need at your disposal. It’s easy to streamline your editing process without acquiring new skills.

Find the appropriate example of Get B3B 2011 and complete it right away without having to switch between your browser windows. Explore additional tools to tailor your Get B3B 2011 form in the editing mode.

While on the Get B3B 2011 page, click on the Get form button to begin modifying it. Enter your information directly into the form, as all the necessary tools are available right here. The template is pre-formatted, so the effort required from the user is minimal. Just utilize the interactive fillable fields in the editor to smoothly finalize your documentation. Click on the form and instantly transition to the editor mode. Complete the interactive field, and your document is ready.

A minor mistake can disrupt the entire form when someone fills it out manually. Eliminate inaccuracies in your paperwork. Discover the templates you require in moments and complete them electronically using an intelligent editing tool.

- Add additional text around the document if required. Use the Text and Text Box tools to insert text in a separate area.

- Incorporate pre-designed visual components such as Circle, Cross, and Check with the respective tools.

- Upload or capture images for the document using the Image tool if necessary.

- To draw in the document, utilize Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to modify the text in the document.

- If you need to annotate specific sections of the document, click on the Sticky tool and position a note where desired.

Related links form

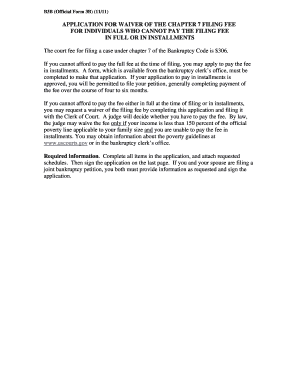

To file an 83B form, you must complete the form accurately, including your name, address, and details about the property and vesting. Afterward, you should send the completed form to the IRS within 30 days of acquiring the stock. Remember to keep a copy for your records and also include a copy with your tax return. For clarity and convenience, tools available on the uslegalforms platform can help streamline your 83B filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.