Loading

Get Ks Form 221.3 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Form 221.3 online

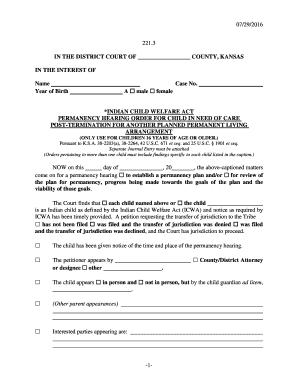

Filling out the KS Form 221.3 online can be straightforward with the right guidance. This form is essential for documenting permanency hearings concerning children in need of care, and it is important to complete each section accurately.

Follow the steps to fill out KS Form 221.3 online.

- Press the ‘Get Form’ button to access the form and open it in the designated online editor.

- In the first section, enter the county details in the space provided. This identifies the court handling the matter.

- Fill in the name of the child and their year of birth. Be sure to select the appropriate gender checkbox, either male or female.

- Input the case number into the appropriate field to associate the form with the specific case.

- Indicate whether the child is considered an Indian child according to the Indian Child Welfare Act by checking the relevant option. This ensures compliance with ICWA regulations.

- Document the appearances of involved parties, including the child, petitioner, and any representatives, by checking the relevant boxes and providing names as needed.

- For each finding related to the child's needs and progress, check the appropriate boxes and provide any necessary explanations in the spaces provided.

- Ensure that the court's decisions about the permanency plan are clearly documented, selecting options that reflect the court's findings.

- After completing the form, review all entries for accuracy. Ensure that all fields are filled appropriately to avoid delays.

- Once verified, you can save your changes, download a copy for your records, print the form, or share it with relevant parties as needed.

Begin completing your KS Form 221.3 online today for an efficient and organized process.

Related links form

Yes, you can file your Kansas state taxes online through various platforms, including the Kansas Department of Revenue's website and tax preparation software. Online filing can streamline your experience and reduce errors. For guidance, the KS Form 221.3 offers valuable insights on the online filing process and essential details to keep in mind.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.