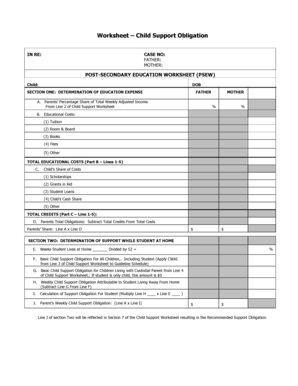

Get In Post-secondary Education Worksheet (psew)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IN Post-Secondary Education Worksheet (PSEW) online

How to fill out and sign IN Post-Secondary Education Worksheet (PSEW) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

US Legal Forms aids you in navigating the process of completing the IN Post-Secondary Education Worksheet (PSEW) and simultaneously makes it quicker and more convenient.

The service will conserve your energy and time in filling out legal documents while guaranteeing safety.

E-filing of the IN Post-Secondary Education Worksheet (PSEW) has never been as simple and quick as with US Legal Forms.

- Utilize the Search Engine to locate the form.

- Access the sample using the comprehensive web-based editor.

- Review the guidelines and directions of the sample to avoid errors while providing necessary information.

- To save you time, the fillable sections are highlighted in yellow. Simply click on them and enter the required information.

- After you have filled in all the fillable sections, date and sign the document.

- Re-examine the blank for errors and inaccuracies and utilize the extensive upper menu toolbar to modify the text.

- Once you have completed filling out the document, just click Done.

- Save the sample to your device for future submission.

- E-submit or print your legal document.

How to Alter Get IN Post-Secondary Education Worksheet (PSEW): Personalize Forms Online

Choose a trustworthy document editing option that you can depend on. Amend, finalize, and authenticate Get IN Post-Secondary Education Worksheet (PSEW) safely online.

Frequently, modifying documents, such as Get IN Post-Secondary Education Worksheet (PSEW), can be problematic, particularly if you obtained them online or through email but lack access to specialized software. Certainly, you can discover some alternatives to circumvent this, but you risk producing a document that may not meet submission requirements. Employing a printer and scanner is not a solution either, as it is both time-consuming and resource-intensive.

We provide a more straightforward and effective method for completing forms. An extensive collection of document templates that are simple to personalize and authenticate, making them fillable for certain users. Our platform goes far beyond just a selection of templates. One of the most advantageous aspects of utilizing our service is that you can edit Get IN Post-Secondary Education Worksheet (PSEW) directly on our site.

As it is an online-based service, it frees you from needing any computer software. Moreover, not all corporate policies allow downloading it on your work computer. Here is how you can easily and securely finalize your documents with our solution.

Bid farewell to paper and other ineffective approaches to completing your Get IN Post-Secondary Education Worksheet (PSEW) or other forms. Opt for our solution instead, which melds one of the most extensive libraries of ready-to-edit templates with a robust document editing feature. It's simple and secure, and it can save you significant time! Don't just take our word for it, experience it yourself!

- Click the Get Form > and you will be instantly directed to our editor.

- Once opened, you can initiate the editing process.

- Choose checkmark or circle, line, arrow and cross among other options to annotate your document.

- Select the date option to insert a particular date into your document.

- Insert text boxes, images, and notes among other elements to enhance the content.

- Use the fillable fields option on the right to create fillable fields.

- Click Sign from the top toolbar to establish and create your legally binding signature.

- Click DONE and save, print, and circulate or obtain the document.

secondary certification is a credential awarded after completing a program beyond high school, often focusing on specific skills or knowledge areas. These certifications can enhance your employability and expertise in various fields. The IN PostSecondary Education Worksheet (PSEW) can assist you in navigating certification options and requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.