Loading

Get Ia Ble Form C 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA BLE Form C online

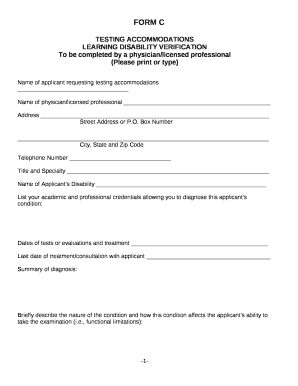

Completing the IA BLE Form C is an important step in requesting testing accommodations for learning disabilities. This guide will provide you with detailed instructions on how to fill out the form online, ensuring a smooth and efficient process.

Follow the steps to fill out the IA BLE Form C effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the name of the person requesting testing accommodations in the designated field. This is crucial for identifying the individual in need of assistance.

- In the next field, input the name of the physician or licensed professional who will be verifying the learning disability. Ensure accuracy to maintain the credibility of the document.

- Fill out the address of the physician or licensed professional, including the street address or P.O. Box number, city, state, and zip code.

- Provide the telephone number of the physician or licensed professional, which is important for potential follow-up communication.

- In the title and specialty section, indicate the professional’s area of expertise relevant to the assessment of the applicant’s learning disability.

- Describe the applicant's disability in the designated field, ensuring clarity and specificity.

- List the academic and professional credentials of the physician or licensed professional that allow them to diagnose the applicant's condition.

- Document the dates of tests or evaluations and any treatment the applicant has undergone.

- Include the last date of treatment or consultation with the applicant, which is necessary for providing context regarding the ongoing support.

- Summarize the diagnosis clearly, including how it impacts the applicant's testing capabilities.

- Provide a brief description of the condition and its effect on the applicant's ability to take the examination, focusing on functional limitations.

- Detail the treatment provided for the condition and comment on its effectiveness.

- Indicate whether the condition is permanent and if it substantially limits the applicant’s performance in major life activities.

- Specify the ways in which the condition restricts the applicant’s activities, particularly in an educational and psychological context.

- Explain how the condition affects the applicant's ability to read, write, process information, or concentrate during the examination.

- Recommend specific testing accommodations that would assist the applicant in taking the examination, along with justifications.

- Clarify the relationship between the recommended accommodations and the applicant's functional limitations, providing examples.

- State any corrective measures that could enhance the applicant's ability to take the examination under standard conditions, if applicable.

- Attach the required supporting reports outlined, which include a review of the assessment process and background information on the applicant’s disability.

- After all fields are completed, save any changes made to the form. You may download, print, or share the completed form as necessary.

Take the next step in securing testing accommodations by completing the IA BLE Form C online today.

Related links form

The abbreviation for BLE in insurance stands for Benefits, Limitations, and Exceptions. This concept is important when analyzing your policy, and the IA BLE Form C can assist you with this task. It helps ensure you comprehend the scope of your coverage, and knowing the BLE aspects can streamline your insurance experience. For deeper insights, platforms like USLegalForms can provide valuable guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.