Get Hi Instructions Income Withholding For Support 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI Instructions Income Withholding for Support online

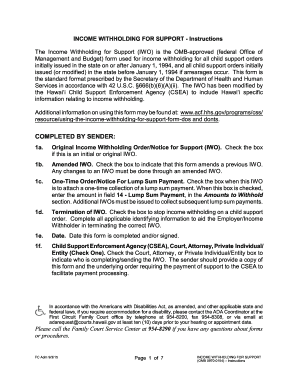

The HI Instructions Income Withholding for Support is a vital document utilized for income withholding concerning child support orders. This guide provides clear, step-by-step instructions on efficiently completing the form online, ensuring compliance and accuracy.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to obtain the HI Instructions Income Withholding for Support form and open it in your preferred online editor.

- Start by filling out Section 1 to indicate the type of income withholding order you are submitting. Check the appropriate box for original IWO, amended IWO, one-time order for lump sum payment, or termination of IWO.

- In Section 1e, input the date the form is completed. This ensures that the timing of the order is accurately documented.

- Select the category of sender in Section 1f by checking the box next to Child Support Enforcement Agency (CSEA), Court, Attorney, or Private Individual/Entity. This informs recipients of who is responsible for the IWO.

- Complete the employer/income withholder details in fields 2a and 2b. Include the name and address of the employer or income withholder responsible for processing the payment.

- Fill in the employee/obligor’s identification details in fields 3a to 3e, including their legal name, social security number, custodial party’s name, and children’s names and birth dates.

- Proceed to Section 4 and provide the order information, specifying the amounts to be withheld for current and past-due child support, cash medical support, and spousal support as applicable in fields 5a-11c.

- In Section 12a, enter the total amount to withhold, ensuring all previous entries total to this amount as prescribed in the underlying support order.

- Complete the remittance information in Section 15, detailing where the payments should be sent. Ensure that all payments comply with local and federal rules for child support withholding.

- At the end of the form, validate it by ensuring sections related to the issuing official’s signature and contact information are filled out. Include the issuer’s name, title, and contact details as required.

- Once all necessary fields are filled, review the form for accuracy, save your changes, and download, print, or share the completed form as needed.

Take the next step in child support compliance by completing the Income Withholding for Support form online today.

Related links form

The new child support law in Indiana includes updates designed to streamline the enforcement and collection of child support payments. It emphasizes the importance of timely payments and the use of income withholding orders. For parents navigating the process, utilizing HI Instructions Income Withholding for Support can help ensure compliance with these updated regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.