Loading

Get Gu Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GU Declaration online

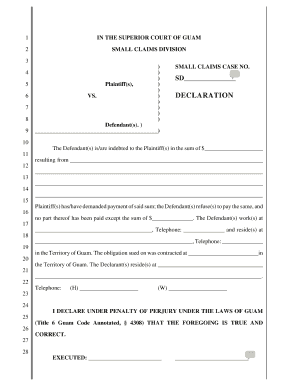

The GU Declaration is a crucial document for presenting claims in the small claims division of the Superior Court of Guam. This guide provides a clear and comprehensive overview of how to fill out this form online, ensuring that you have the information needed to proceed confidently.

Follow the steps to complete your GU Declaration online.

- Press the ‘Get Form’ button to access the GU Declaration form, which will open in your selected format for editing.

- In the section labeled 'Plaintiff(s)', enter the name(s) of the person or entity making the claim. Ensure that the names are spelled accurately to avoid any miscommunication.

- Next, fill in the 'Defendant(s)' section with the name(s) of the person or entity you are filing against, ensuring consistency with official documents.

- In the area designated for the 'Small Claims Case No.', leave this space blank if you do not have a case number provided. This will be filled in by the court.

- Provide the total amount of debt owed in the specified sum field and be sure to describe the basis of your claim in the space provided. Detail is key here.

- Indicate the amount that has already been paid by the defendant in the appropriate area to clarify the outstanding balance.

- Input the employment information of the defendant, including where they work and their contact number, which may assist in case follow-ups.

- Add the residence details of the defendant to ensure accurate service of the declaration and any future correspondence.

- In the section for the declarant, fill in your address and any relevant contact information to facilitate communication.

- Review your entries for accuracy and completeness. When satisfied, sign and date the document in the designated area, confirming that all information is true under penalty of perjury.

- Finally, save your changes, and you may choose to download, print, or share the completed form as necessary.

Get started on your GU Declaration today and submit your claim online with confidence.

Related links form

The term 'benefits repaid' on a 1099-G refers to amounts you returned to the government, often for unemployment benefits. If you had to repay benefits, this may affect how you report income, particularly in your GU Declaration. Ensure you understand this impact when filing your taxes to avoid any discrepancies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.