Loading

Get Sc 501(c)(3) Attachment 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC 501(c)(3) Attachment online

Filling out the SC 501(c)(3) Attachment is an essential step for nonprofits seeking tax-exempt status from the Internal Revenue Service. This guide provides you with clear, step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to successfully complete the SC 501(c)(3) Attachment.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

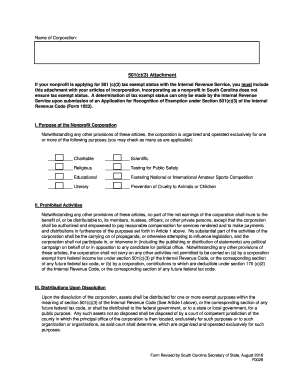

- Begin with the section titled 'Purpose of the Nonprofit Corporation.' Here, select all the applicable purposes that your organization will serve by checking the corresponding boxes. You may choose more than one option.

- Move to 'Prohibited Activities.' Carefully read the provided statement to ensure your organization will comply with these guidelines. You will not need to enter any information for this section; just be aware of these prohibitions while conducting your organizational activities.

- Next, proceed to 'Distributions Upon Dissolution.' This section outlines how your organization's assets will be handled in the event of dissolution. Ensure you understand these stipulations, as they are important for compliance with IRS regulations.

- Once you have completed all sections, review your entries to make sure everything is accurate and consistent.

- Finally, you can save your changes, download the completed form, print it for your records, or share it digitally as required for further submission.

Begin completing your SC 501(c)(3) Attachment online today to advance your nonprofit's journey!

You write 501(c)(3) as a sequence of numbers and letters, ensuring you include the parentheses correctly. This format represents the specific section of the Internal Revenue Code that provides tax-exempt status to qualifying nonprofits. Clarity in representation is essential, especially when discussing your SC 501(c)(3) Attachment with potential donors or grantors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.