Get Ca Sc-101 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

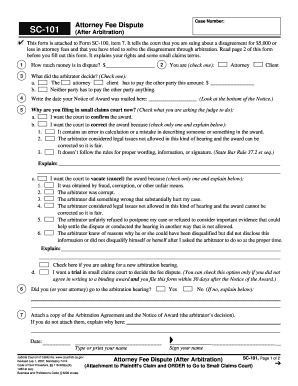

Tips on how to fill out, edit and sign CA SC-101 online

How to fill out and sign CA SC-101 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Fulfilling the online CA SC-101 is not truly a difficult task.

You ought to answer the inquiries one at a time and refrain from omitting anything.

If you detect an error in the CA SC-101 after it has been submitted to the relevant authorities, it is advisable to rectify it at the earliest chance and resend the submission. This can protect you from disputes and demonstrate your accountability.

- To prevent errors, you simply need to choose the finest support, such as US Legal Forms.

- It will make any legal procedure as straightforward and effortless as possible.

- Follow the instructions regarding how to finalize CA SC-101:

Click the orange key to begin the CA SC-101.

Activate the useful Wizard tool on the top menu for enhanced assistance on the web-template.

Input the correct information into each of the clickable fields.

Utilize additional subkeys to advance forward.

Adhere to the instructions ? enter text and numbers, supply checkmarks.

Sign digitally with a legally recognized eSign.

Once finished, select Done.

Present a ready-made legal template in your browser or print and download it.

How to modify Get CA SC-101 2007: personalize forms online

Sign and distribute Get CA SC-101 2007 along with any other commercial and individual documents online without squandering time and resources on printing and mailing. Utilize our online form editor equipped with an integrated compliant eSignature feature to maximize your efficiency.

Approving and submitting Get CA SC-101 2007 documents electronically is faster and more efficient than handling them on paper. However, it necessitates the use of online tools that ensure a high level of data protection and give you a certified resource for creating eSignatures. Our robust online editor is precisely what you need to prepare your Get CA SC-101 2007 and other personal, business, or tax forms accurately and in accordance with all regulations. It provides all necessary tools to swiftly and simply complete, modify, and sign documents online, as well as add Signature fields for additional parties, detailing who and where should sign.

It takes just a few easy steps to complete and sign Get CA SC-101 2007 online:

Share your documents with others using one of the available methods. When approving Get CA SC-101 2007 with our powerful online solution, you can always be confident that it is legally binding and admissible in court. Prepare and submit documents in the most productive way possible!

- Open the chosen file for further editing.

- Utilize the upper toolkit to insert Text, Initials, Image, Check, and Cross marks to your document.

- Highlight the key details and black out or eliminate sensitive information if needed.

- Click on the Sign tool above and choose how you wish to eSign your document.

- Sketch your signature, type it, upload an image of it, or select another option that fits you.

- Proceed to the Edit Fillable Fields panel and add Signature fields for additional parties.

- Click on Add Signer and input your recipient’s email to assign this field to them.

- Verify that all provided information is complete and accurate before you click Done.

Get form

The number of allowances you should claim in California depends on your specific financial situation, including your income and the number of dependents. Generally, the more allowances you claim, the less tax will be withheld from your paycheck. For assistance in determining the right number for your scenario, consider utilizing the CA SC-101 for personalized advice.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.