Get Ca Rrf-1 Instructions 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA RRF-1 Instructions online

How to fill out and sign CA RRF-1 Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing the online CA RRF-1 Guidelines is not an intricate task.

You should respond to the inquiries sequentially and make an effort not to overlook any.

If you discover an error in the CA RRF-1 Guidelines after it has been submitted to the relevant authorities, it’s advisable to correct it at the earliest opportunity and resend the report. This will protect you from issues and demonstrate your diligence.

- Utilize the orange button to initiate the CA RRF-1 Guidelines.

- Enable the smart Wizard tool located in the upper bar for enhanced support on the template.

- Input the relevant information into each of the interactive fields.

- Employ additional subkeys to proceed.

- Adhere to the prompts — insert text and figures, utilize checkmarks.

- Authenticate electronically using a legally enforceable eSign.

- When finished, click Done.

- Submit a prepared legal web-template online or print and download it.

How to Revise Get CA RRF-1 Instructions 2005: Personalize Templates Online

Choose a trustworthy file editing solution you can rely on. Alter, finalize, and validate Get CA RRF-1 Instructions 2005 securely online.

Frequently, altering documents, such as Get CA RRF-1 Instructions 2005, can prove difficult, particularly if they were received electronically or via email but specific tools are unavailable. While there are potential workarounds, they may lead to a form that fails to comply with submission standards. Using a printer and scanner can also be impractical due to the time and resources involved.

We offer a more seamless and efficient method of altering files. A comprehensive array of document templates that are easy to personalize and verify, making them fillable for others. Our platform goes far beyond a mere assortment of templates. One of the foremost advantages of utilizing our service is that you can modify Get CA RRF-1 Instructions 2005 directly on our site.

Being a web-based service, it eliminates the need for any software installation. Moreover, not all company policies permit you to install it on your work laptop. Here's the simplest method to effectively and securely finalize your documentation using our platform.

Forget traditional methods and the inefficiencies of handling your Get CA RRF-1 Instructions 2005 or other documents. Opt for our solution that combines one of the most extensive collections of ready-to-edit templates with a robust file editing feature. It's user-friendly and secure, and can save you a significant amount of time! Don’t just take our word for it, experience it for yourself!

- Click the Get Form > you'll be swiftly directed to our editor.

- Upon opening, you can begin the personalization procedure.

- Choose checkmarks, circles, lines, arrows, crosses, and other tools to annotate your document.

- Select the date option to insert a specific date into your document.

- Incorporate text boxes, images, notes, and additional elements to enhance the content.

- Utilize the fillable fields feature on the right to produce fillable {fields.

- Select Sign from the top menu to create and generate your legally-recognized signature.

- Click DONE and save, print, circulate, or obtain the final output.

Get form

Related links form

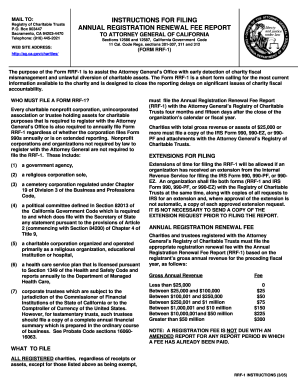

The California Annual Treasurer's Report is a document that provides information regarding a nonprofit organization's financial status. This report includes details about income, expenditures, and overall financial health. Filing this report helps maintain transparency and trust among donors and the public, so it is essential to adhere to reporting guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.