Loading

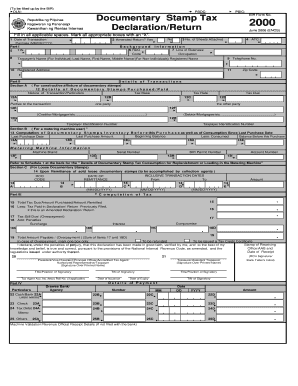

Get Bir Form 2000 June 2006 Excel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 2000 June 2006 Excel online

This guide provides a comprehensive overview of how to complete the Bir Form 2000 June 2006 Excel online. By following the outlined steps, you will be able to navigate each section of the form with ease, ensuring accurate submission.

Follow the steps to successfully fill out the Bir Form 2000 June 2006 Excel online.

- To begin, press the ‘Get Form’ button to obtain the form and open it in your browser or suitable application.

- Enter the date of the transaction in the designated field. Ensure this is in the format MM/DD/YYYY.

- Indicate whether this is an amended return by marking the appropriate box with an ‘X’.

- Fill in the number of sheets attached to the form if applicable.

- Input the Alphanumeric Tax Code (ATC) related to your transaction.

- Provide your Tax Identification Number (TIN) in the relevant section.

- Enter the Revenue District Office (RDO) code assigned to you.

- Describe your line of business or occupation along with a valid telephone number.

- Complete the taxpayer's name section, entering last name, first name, and middle name for individuals, or registered name for non-individuals.

- Fill in the registered address including the zip code.

- Part II requires you to detail the nature of the transaction. Include necessary particulars, tax base, and tax rate, marking the parties involved with their Taxpayer Identification Numbers.

- If applicable, proceed to Section B to compute your documentary stamps inventory before this purchase.

- Complete Section C details if you are a loose documentary stamps user.

- In Part III, compute the total tax due, subtract any tax paid from previous declarations, and calculate any penalties if necessary.

- Instruct whether you prefer to have an overpayment refunded or issued as a tax credit certificate.

- Finally, review all entries for accuracy. Save your changes, and proceed to download or print the completed form for submission.

Complete your documents online efficiently by following the guide.

To download BIR forms, visit the official BIR website and navigate to the forms section. You will find a comprehensive list of available forms, including downloadable PDFs and Excel formats like the Bir Form 2000 June 2006 Excel. Choose the appropriate forms you need, and follow the instructions to download them easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.