Get How To Use Tax Exempt At Dollar General 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Use Tax Exempt At Dollar General online

This guide provides clear instructions on how to complete the How To Use Tax Exempt At Dollar General form. By following these steps, you can ensure you correctly submit your tax-exempt information for processing.

Follow the steps to successfully complete your tax-exempt form.

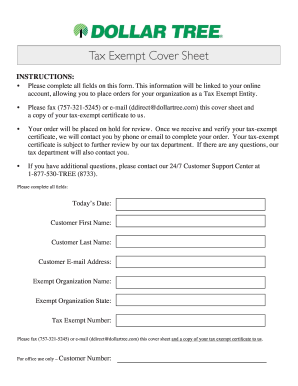

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out 'Today’s Date' to indicate when you are completing the form.

- Enter your 'Customer First Name' into the designated field. This should be your first name as it appears on official documents.

- Fill in your 'Customer Last Name' in the appropriate section. Ensure that this is spelled correctly for verification purposes.

- Provide a valid 'Customer E-mail Address' where you can receive confirmations or updates regarding your submission.

- In the 'Exempt Organization Name' field, include the official name of your tax-exempt organization.

- Specify the 'Exempt Organization State' to indicate where your organization is registered.

- Enter your 'Tax Exempt Number' in the corresponding field. This number is essential for processing your exemption.

- After completing all fields, ensure to fax (757-321-5245) or email (ddirect@dollartree.com) this cover sheet along with a copy of your tax-exempt certificate.

- Wait for confirmation. Your order will be on hold for review until your tax-exempt certificate has been verified.

- Once verified, you will be contacted via the provided contact method to complete your order.

- Finally, save your completed form, and if needed, download, print, or share it for your records.

Start filling out your tax-exempt form online today to ensure a smooth ordering process.

To apply for tax-exempt status at Dollar Tree, visit their website or contact customer service for the necessary forms. Fill in the required details and provide any supporting documentation that verifies your tax-exempt status. Once your application is processed, you can shop without paying sales tax on qualified purchases. Knowing how to use tax exempt at Dollar General can also be beneficial, particularly if you regularly shop at multiple stores.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.